Tax Pitfalls to Avoid: A Guide for UK Businesses and Inheritance Tax Issues

Discover key tax pitfalls to avoid and learn how businesses can better manage tax responsibilities and inheritance issues effectively.

Tax Pitfalls to Avoid: A Guide for UK Businesses and Inheritance Tax Issues

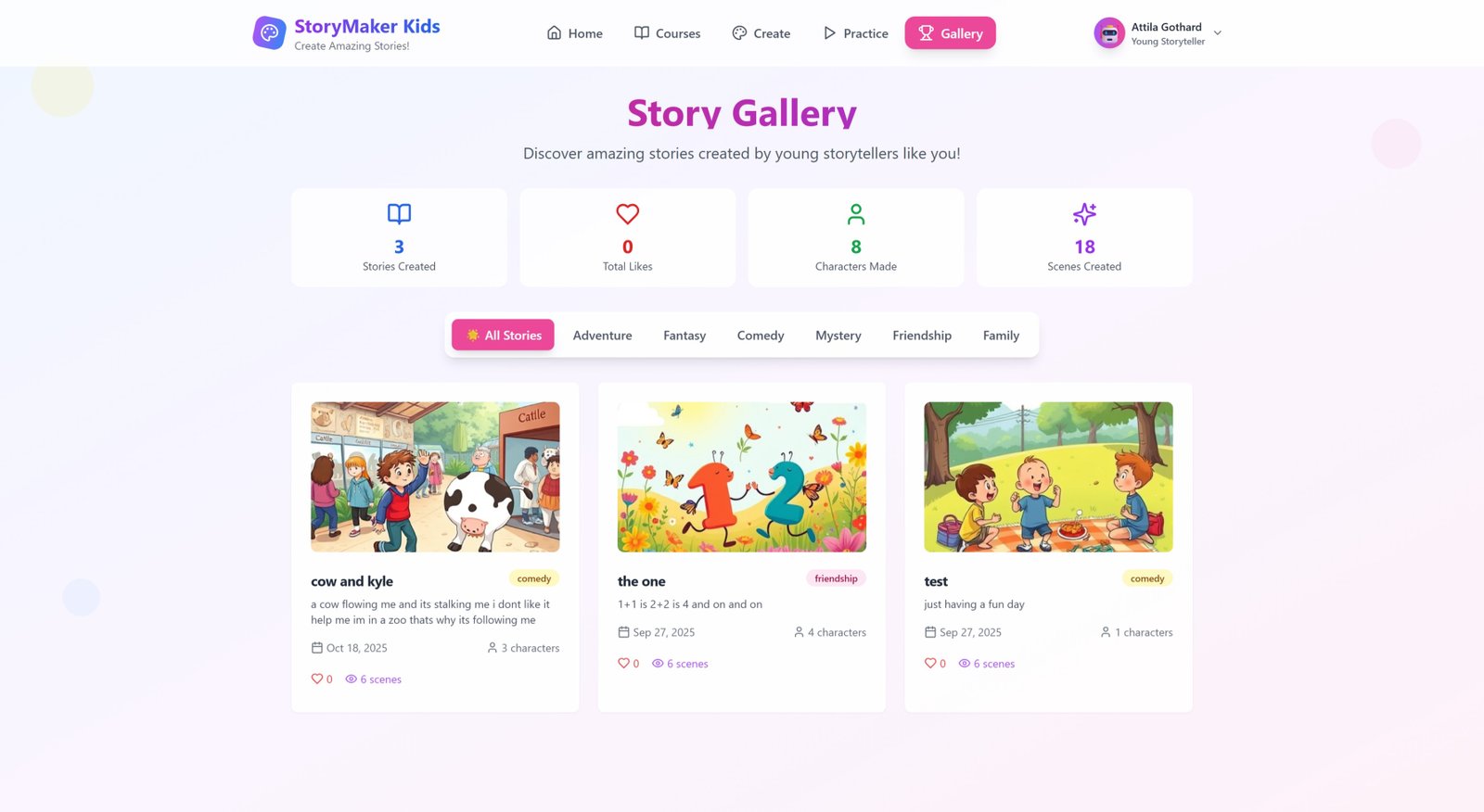

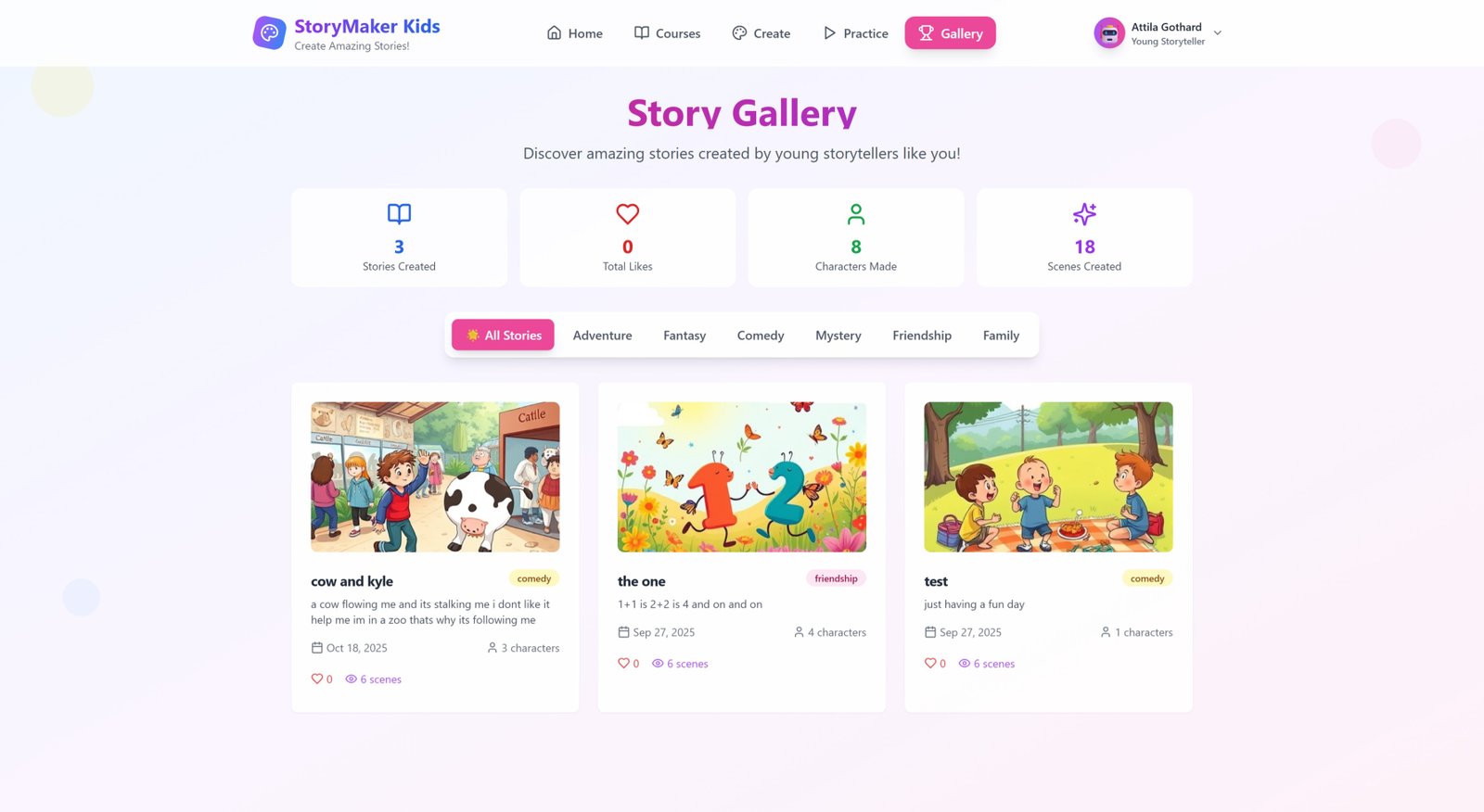

Running a business requires careful planning, sound financial management, and a clear understanding of tax responsibilities. Many business owners focus heavily on growth and operations but overlook the hidden financial risks that can arise from tax missteps. When exploring Tax Pitfalls to Avoid: A Guide for UK Businesses and Inheritance Tax Issues, it becomes evident that even small errors can lead to penalties, unexpected liabilities, or long-term financial loss. Working with experienced professionals such as Lanop Business and Tax Advisor can help businesses maintain compliance while safeguarding their financial future. Because Tax Pitfalls to Avoid: A Guide for UK Businesses and Inheritance Tax Issues covers a broad range of risks, understanding these challenges early is essential for managing both business and personal wealth effectively.

Understanding Common Tax Pitfalls for Businesses

Many businesses underestimate how easy it is to make simple mistakes in their tax processes. These mistakes often occur not because of negligence but because of misunderstanding, oversight, or rapid business growth.

1. Inaccurate Record-Keeping

Accurate financial record-keeping is essential for compliance. Incomplete or inconsistent records lead to errors in tax filings, incorrect claims, and potential fines. Businesses should ensure that all financial transactions, expenses, income, and payroll details are documented clearly and consistently.

2. Misclassification of Expenses

One of the most common tax pitfalls is misunderstanding what qualifies as a deductible expense. Businesses sometimes misclassify personal costs as business expenses or overlook legitimate deductions, both of which create unnecessary problems. The goal is to be precise, avoiding over-claiming or inappropriate categorisation.

3. Failure to Meet Tax Deadlines

Missing tax deadlines results in penalties, interest charges, and administrative consequences. Businesses often fall behind due to poor planning or lack of awareness of key dates. Ensuring timely submissions prevents unnecessary financial strain and helps maintain smooth operations.

4. Neglecting Payroll Responsibilities

Proper handling of payroll requires accurate calculations and compliance with employment regulations. Mistakes in employee compensation, deductions, or reporting obligations can quickly escalate into major issues if not addressed promptly.

Strategic Tax Planning for Businesses

Tax planning should not be an afterthought. Businesses benefit from creating strategic plans that reduce liabilities, optimise financial decisions, and ensure long-term stability.

Structuring the Business Correctly

Choosing the correct business structure influences liability, taxation, and financial flexibility. A poorly selected structure may result in higher tax burdens or limitations that affect growth. Reviewing and adjusting the structure as the business evolves is crucial.

Understanding Allowances and Reliefs

Many businesses miss out on legitimate allowances and reliefs simply because they are unaware of their eligibility. Ensuring that reliefs are identified and claimed properly helps reduce overall taxation without risk of non-compliance.

Planning for Cash Flow and Tax Bills

Unexpected tax bills can disrupt operations. Effective tax planning includes preparing for upcoming obligations, projecting tax liabilities, and keeping sufficient reserves. Allocating resources wisely prevents last-minute financial stress.

A Closer Look at Inheritance Tax Issues

While business taxes require close attention, personal wealth planning—particularly regarding inheritance tax—is equally important. The topic of Tax Pitfalls to Avoid: A Guide for UK Businesses and Inheritance Tax Issues highlights the connection between business ownership and personal estate responsibilities.

Understanding Inheritance Tax Exposure

Inheritance tax can create significant financial challenges for families, especially when business assets are involved. Without proper planning, beneficiaries may face large tax liabilities, forcing them to sell assets or restructure the business unexpectedly.

Valuation of Business Assets

One of the most sensitive areas in inheritance tax planning is the valuation of business assets. Under- or over-valuation can impact tax calculations and raise legal complications. Ensuring accurate and compliant valuation protects both the estate and beneficiaries.

Failure to Use Available Reliefs

Certain reliefs are available to individuals who include business assets in their estate planning. Not taking advantage of these reliefs often results in higher inheritance tax than necessary. Awareness and planning provide long-term financial benefits.

Lack of a Succession Plan

Without a clear succession plan, families are often left scrambling to make decisions under pressure. Establishing a structured plan ensures continuity, reduces confusion, and minimises tax exposure.

Bridging Business Tax Management and Inheritance Planning

For business owners, tax responsibilities extend beyond day-to-day operations. The intersection of business and personal wealth means that decisions have long-term consequences. Effective planning requires a holistic view, covering business taxes, operational processes, and future inheritance considerations.

Integrating Business Decisions with Personal Goals

Tax strategies should align with personal financial objectives. Whether planning for retirement, growth, or family succession, each decision can impact tax obligations. Consistent evaluation ensures alignment between business practices and personal priorities.

Avoiding Overlooked Tax Interactions

Many business owners fail to recognise how personal and commercial taxes interact. This lack of understanding often leads to duplicated tax liabilities or missed opportunities for optimisation. Awareness and proactive planning prevent these issues.

Balancing Growth with Compliance

Ambitious growth plans must be accompanied by diligent compliance. Scaling a business increases complexity, and without proper tax management, growth can quickly turn into a burden. Staying informed and organised helps businesses expand responsibly.

Best Practices to Prevent Tax Pitfalls

Preventing tax pitfalls requires a proactive approach. The following best practices support stability, compliance, and financial health:

- Regular financial reviews to ensure accuracy and detect issues early.

- Clear documentation processes for all transactions.

- Professional support when navigating complex tax or inheritance matters.

- Continuous training for in-house teams to stay updated with regulations.

- Long-term planning to manage both business and personal tax responsibilities.

Consistency and careful management help businesses avoid the common traps that lead to unnecessary difficulties.

Conclusion

Understanding the complexities outlined in Tax Pitfalls to Avoid: A Guide for UK Businesses and Inheritance Tax Issues enables business owners to protect their operations, assets, and future plans. Whether dealing with daily business tax obligations or long-term inheritance considerations, the key is proactive, informed management. By maintaining accurate records, planning strategically, and approaching inheritance tax thoughtfully, individuals and organisations can reduce risk and build secure foundations for the future. With support from experts like Lanop Business and Tax Advisor, businesses can navigate these challenges confidently while avoiding costly mistakes.

What's Your Reaction?