Target Drone Market Outlook 2031: Rising Geopolitical Instability and Enhanced UAV Adoption Drive Strong Global Growth

Target Drone Market (Platform: Ground Target, Aerial Target, Underwater Target, and Sea Surface Target; and Engine Type: Internal Combustion Engine, Jet Engine, and Others) - Global Industry Analysis, Size, Share, Growth, Trends, and Forecast 2023-2031

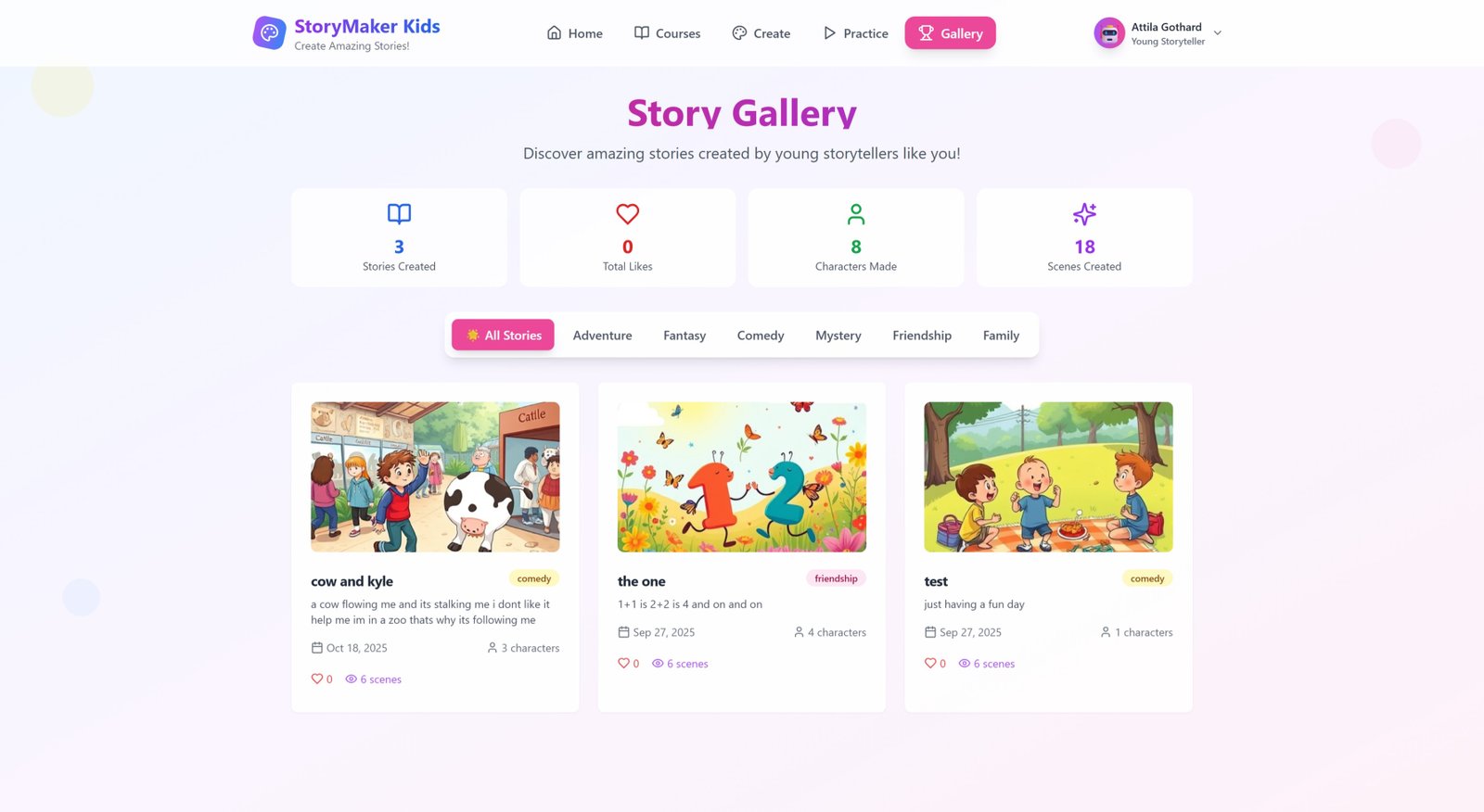

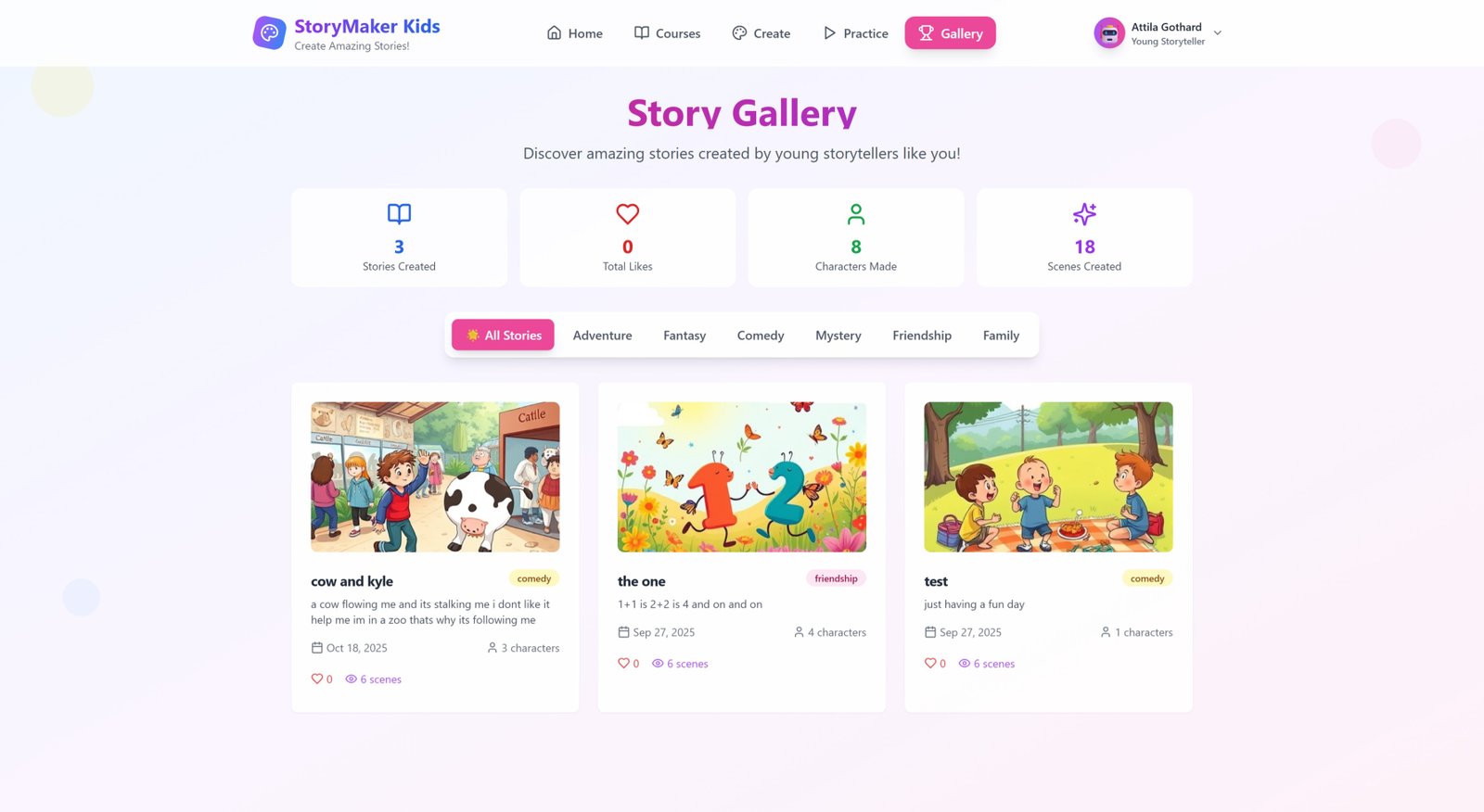

The global target drone market is entering a period of strong and sustained expansion as evolving warfare dynamics, geopolitical tensions, and rapid advancements in unmanned aerial technologies reshape defense strategies worldwide. Valued at US$ 5.5 billion in 2022, the industry is projected to grow at a robust CAGR of 10.7% from 2023 to 2031, reaching US$ 9.3 billion by the end of 2031. As armed forces across major economies seek more efficient and realistic training and testing systems, target drones have become indispensable in modern military preparedness.

Analyst Viewpoint

The surge in geopolitical tensions, particularly across regions such as Russia–Ukraine, Israel–Iran, and China–Taiwan, remains one of the primary forces accelerating the global demand for target drones. Nations are increasingly compelled to reassess defense capabilities, upgrade air-defense systems, and conduct high-precision training simulations. Target drones enable these missions by providing realistic threat simulations without risking personnel or high-value equipment.

Manufacturers are responding with innovative precision drones, autonomous target systems, and jet-powered unmanned platforms capable of mimicking advanced enemy aircraft. Increased adoption of unmanned aerial vehicles (UAVs) for defense applications further augments market expansion, as UAV-based target systems offer agility, advanced maneuverability, and lower operational costs compared to conventional manned aircraft.

Global Target Drone Market Introduction

Target drones are specialized unmanned aerial vehicles designed to simulate real-world threats for anti-aircraft training, missile testing, and evaluation of defensive weapon systems. Traditionally resembling remote-controlled aircraft, modern target drones now incorporate advanced features such as autonomous navigation, radar reflectors, countermeasures, and high-speed propulsion systems to replicate the flight characteristics of hostile aircraft.

Beyond military use, target drones today also serve niche applications in aerial mapping, surveying, and provision of internet services in remote regions. Historically, militaries repurposed older missiles or aircraft by removing warheads and converting them into remotely operated target platforms. This trend continues, with countries such as the United States transforming decommissioned fighter jets into aerial targets for the Air Force, Navy, and Marine Corps.

Rise in Global Geopolitical Tensions Fueling Market Demand

Increasing geopolitical volatility remains the strongest catalyst for target drone procurement worldwide. Conflict zones such as the Russia–Ukraine war have pushed nations to strengthen defensive training programs and validate anti-aircraft response systems under realistic conditions.

For instance, in February 2023, the United States pledged US$ 2 billion in military assistance to Ukraine, including ammunition and target drones, highlighting their critical role in contemporary warfare. Similarly, defense expenditure is rising sharply across regions sensitive to border conflicts.

According to SIPRI, India ranked as the fourth-largest defense spender in 2022, investing US$ 84 billion, with nearly 23% allocated to equipment and infrastructure along its borders with China and Pakistan. This reflects a broader global trend wherein nations bolster combat readiness in response to the rapidly evolving threat landscape.

Target drones provide militaries with an efficient, cost-effective, and safe means to evaluate weapon systems and train personnel without jeopardizing human life, thereby reinforcing their strategic importance.

Increase in Adoption of UAVs Driving Market Expansion

The rapid evolution and adoption of UAV technology are reshaping the target drone market. Modern UAV-based target drones offer several advantages, including:

- High maneuverability and agility

- Cost-effectiveness compared to piloted aircraft

- Reduced risk to human operators

- Compatibility with advanced sensors and electronic warfare systems

These features make UAV target systems ideal for training operators to respond to stealth aircraft, drones, and electronic warfare-enabled adversaries.

In 2023, the U.S. military revived efforts to develop an advanced target drone capable of mimicking enemy stealth jets, a key indicator of the growing need for next-generation target systems. As drone warfare expands globally, investments in target drones—both for training and combat scenario replication—are expected to accelerate.

Regional Outlook

North America Dominates the Market

North America held the largest share of the global target drone market in 2022. The United States remains the world’s leading defense spender, accounting for nearly 40% of global military expenditure. According to SIPRI, U.S. defense spending increased by US$ 71 billion between 2021 and 2022, driven largely by support for Ukraine and modernization of military assets.

The region benefits from:

- High defense budgets

- Strong government procurement programs

- Presence of major defense contractors such as Boeing, Lockheed Martin, Northrop Grumman, and Kratos Defense

These companies actively develop and supply advanced target drones to the U.S. Army, Navy, and Air Force.

Asia Pacific Exhibiting Rapid Growth

Asia Pacific is expected to display a prominent growth rate during 2023–2031 fueled by rising military spending across China, India, Japan, and Taiwan.

Australia, for example, invested nearly US$ 12 billion in military research and acquisition from 2018–2022 in response to growing tensions in the Indo-Pacific. The region’s heightened focus on aerial defense training and UAV technology adoption positions Asia Pacific as a key revenue generator in the coming years.

Analysis of Key Players

Leading companies in the global target drone market are investing heavily in research and development to offer highly capable unmanned target systems. Many are entering strategic partnerships to expand product portfolios and enhance technical capabilities.

Key companies include:

AeroTargets International LLC, Airbus SE, AVIC, The Boeing Company, Griffon Aerospace, Kratos Defense & Security Solutions, Leonardo S.p.A., Lockheed Martin Corporation, Northrop Grumman Corporation, QinetiQ Target Systems, Saab AB, Safran S.A., Textron Systems, and Denel Dynamics.

These players provide a range of platforms, including aerial, sea surface, underwater, and ground targets, as well as various engine types such as internal combustion and jet propulsion.

Key Developments

- August 2023: Advanced Technology International received a contract for the 5th Generation Aerial Target (5GAT) prototype, designed to replicate Russian and Chinese stealth aircraft capabilities.

- July 2023: Kratos Defense secured a US$ 95 million contract to supply high-performance unmanned target systems to the U.S. Army, reaffirming its strong position in the market.

Conclusion

With geopolitical tensions escalating, militaries worldwide are prioritizing realistic training solutions and advanced target systems to strengthen defensive preparedness. Combined with the rapid integration of UAV technologies, the target drone market is poised for sustained growth through 2031. Backed by strong investments, defense modernization programs, and technological innovation, the global market will continue playing a crucial role in shaping the future of military training and threat simulation.

What's Your Reaction?