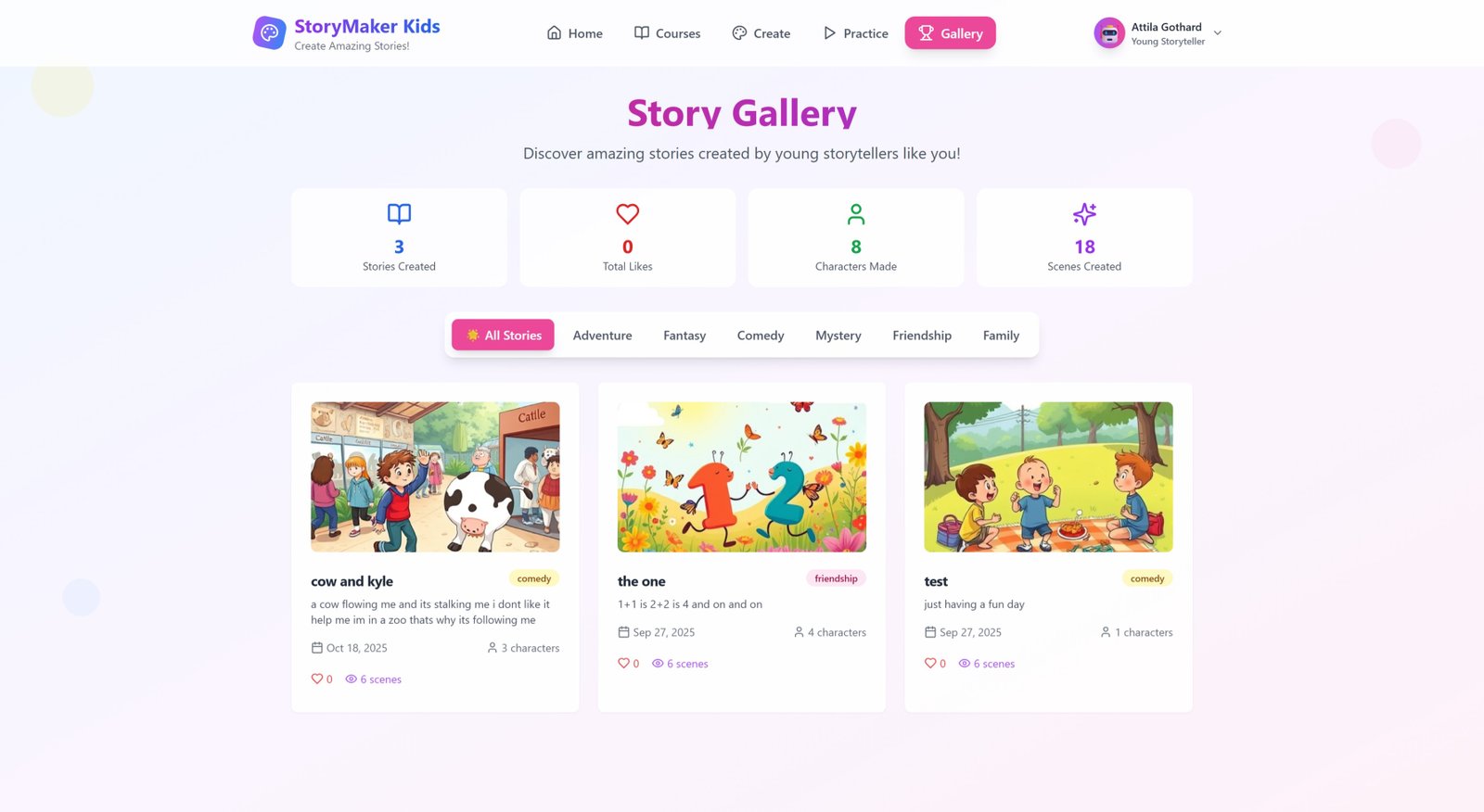

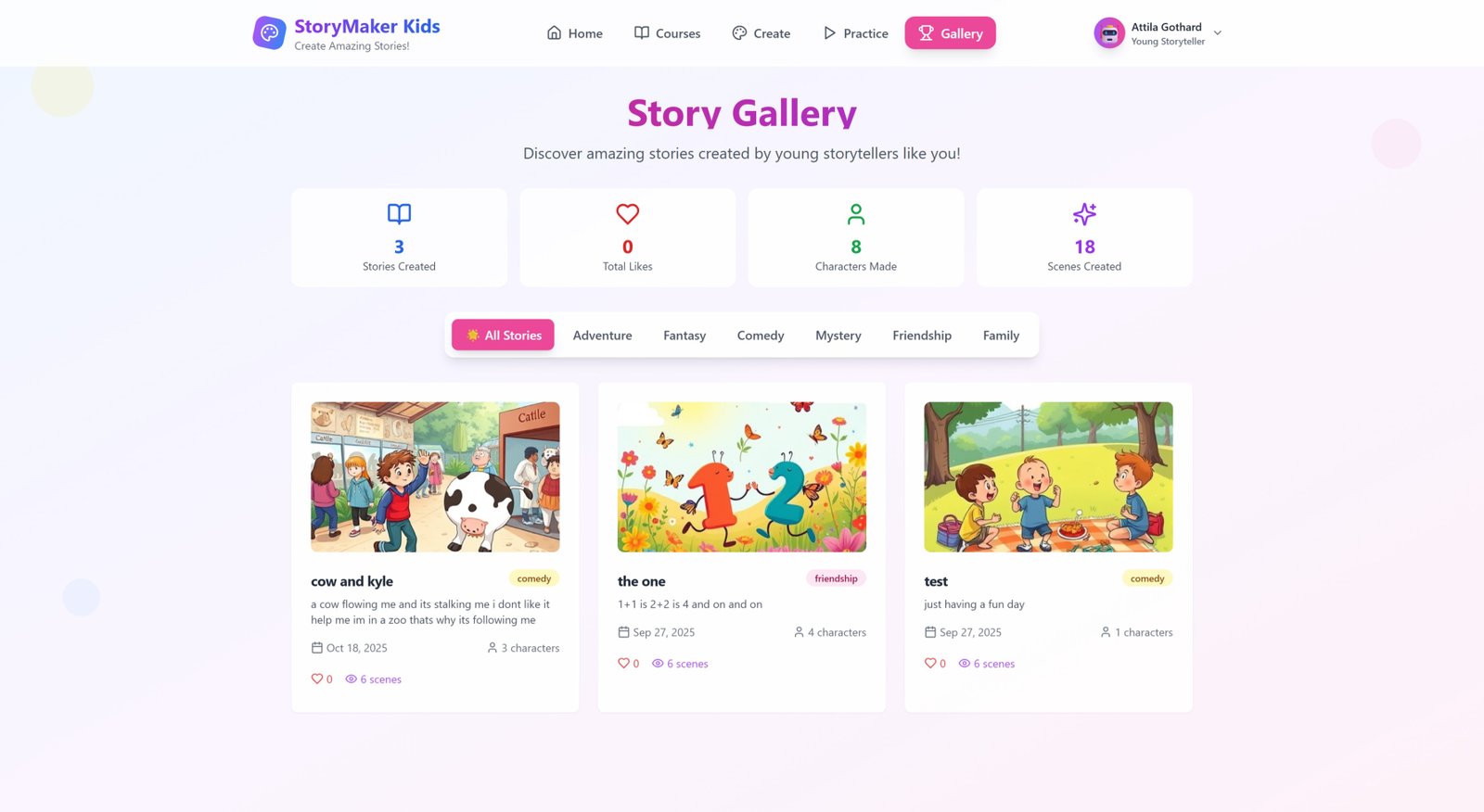

Germany Private Equity Market Analysis Report, Share, and Outlook to 2025

The Germany private equity market reached a size of USD 35,321.38 Million in 2024. It is projected to grow at a compound annual growth rate (CAGR) of 8.80% during the forecast period of 2025 to 2033, reaching USD 75,456.69 Million by 2033.

Market Overview

The Germany private equity market reached a size of USD 35,321.38 Million in 2024. It is projected to grow at a compound annual growth rate (CAGR) of 8.80% during the forecast period of 2025 to 2033, reaching USD 75,456.69 Million by 2033. The market expansion is driven by strong economic fundamentals, an industrial base, and increasing institutional investor interest. Government support for innovation and digital transformation in SMEs, cross-border deal activity, and sector diversification additionally contribute to the market growth.

Study Assumption Years

- Base Year: 2024

- Historical Year/Period: 2019-2024

- Forecast Year/Period: 2025-2033

Germany Private Equity Market Key Takeaways

- The Germany private equity market size was USD 35,321.38 Million in 2024.

- The market is expected to grow at a CAGR of 8.80% during 2025-2033.

- The forecast period is from 2025 to 2033.

- ESG integration is becoming a pivotal part of investment strategies, focusing on decarbonization, board diversity, and sustainability reporting.

- Mid-market deal activity is increasing, especially targeting family-owned and Mittelstand companies for succession and growth capital.

- The first BaFin-approved European Long-Term Investment Fund (ELTIF) launched in 2025 aims to democratize private equity for retail investors.

- Institutional investors are attracted by lower entry valuations and scalability opportunities.

Sample Request Link: https://www.imarcgroup.com/germany-private-equity-market/requestsample

Market Growth Factors

The Germany private equity market is fueled by robust economic fundamentals and a strong industrial base, coupled with rising interest from institutional investors. Government initiatives supporting innovation and the digital transformation of small and medium enterprises (SMEs) further enhance investment appeal, fostering a conducive environment for private equity growth.

The integration of environmental, social, and governance (ESG) considerations into investment decisions is a significant growth driver. Firms are actively incorporating ESG metrics within due diligence and portfolio management. Particular emphasis is on decarbonization, diversity in leadership, and sustainability reporting. This shift reflects increasing EU regulatory pressures and investor demand for transparency and responsibility, bolstering capital deployment towards sustainable assets.

Mid-market transactions dominate the deal landscape, especially in healthcare, technology, and industrial automation. Private equity firms target family-owned and Mittelstand companies seeking succession planning or growth capital. Post-pandemic recovery has accelerated this segment’s deal volume, driven by attractive valuations and growth prospects. Strategic operational involvement and sector consolidation further boost value creation and market expansion.

Market Segmentation

Fund Type Insights

- Buyout: Includes leveraged buyouts and management buyouts, serving mature companies with growth or restructuring needs.

- Venture Capital (VCs): Focused on early-stage investments in innovative startup companies with high growth potential.

- Real Estate: Investments in property assets and development projects as part of diversified private equity portfolios.

- Infrastructure: Involves financing physical structures and facilities critical to economic development.

- Others: Encompasses all other fund types not classified above.

Regional Insights

- Western Germany: Major regional market contributing substantially to private equity investments.

- Southern Germany: Key region with significant private equity activities.

- Eastern Germany: Emerging region with growing investment interest.

- Northern Germany: Active region in private equity deployment.

Regional Insights

Western Germany is identified as a dominant region in the private equity market with significant investments. The report describes Western, Southern, Eastern, and Northern Germany as key regional markets, underlying their importance in shaping the overall market dynamics.

Recent Developments & News

- In June 2025, Deutsche Private Equity (DPE) acquired a majority stake in CPM Partners, a Geneva-based firm specializing in Corporate Performance Management, aiming to expand CPM's capabilities in transformation projects.

- In January 2025, VBL (Versorgungsanstalt des Bundes und der Länder) announced plans to increase its private equity and private debt allocations, signaling a focus on alternative assets to diversify risks and enhance returns amid evolving market conditions.

Key Players

- EQT X

- Munich Private Equity

- Deutsche Private Equity (DPE)

- VBL (Versorgungsanstalt des Bundes und der Länder)

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

What's Your Reaction?