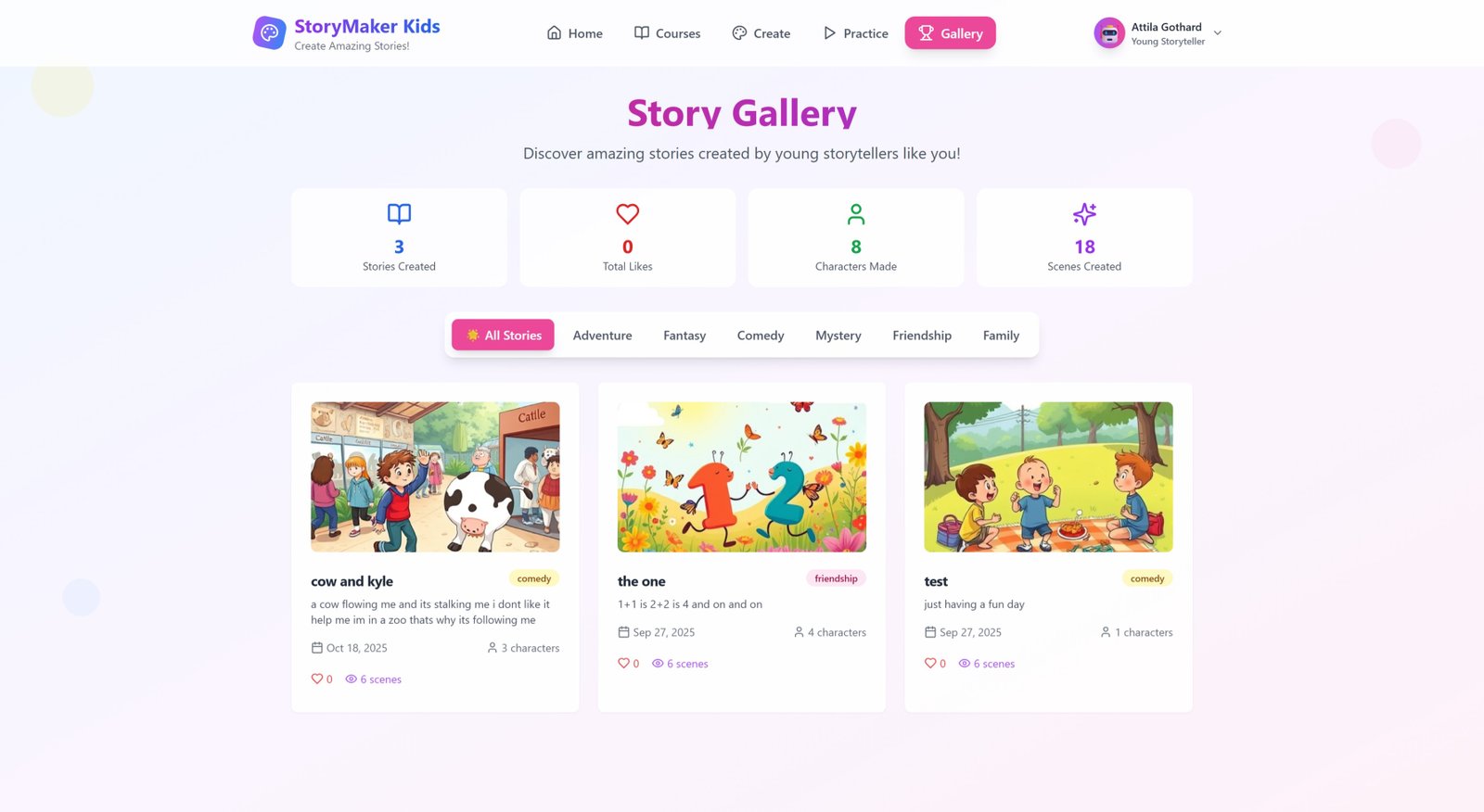

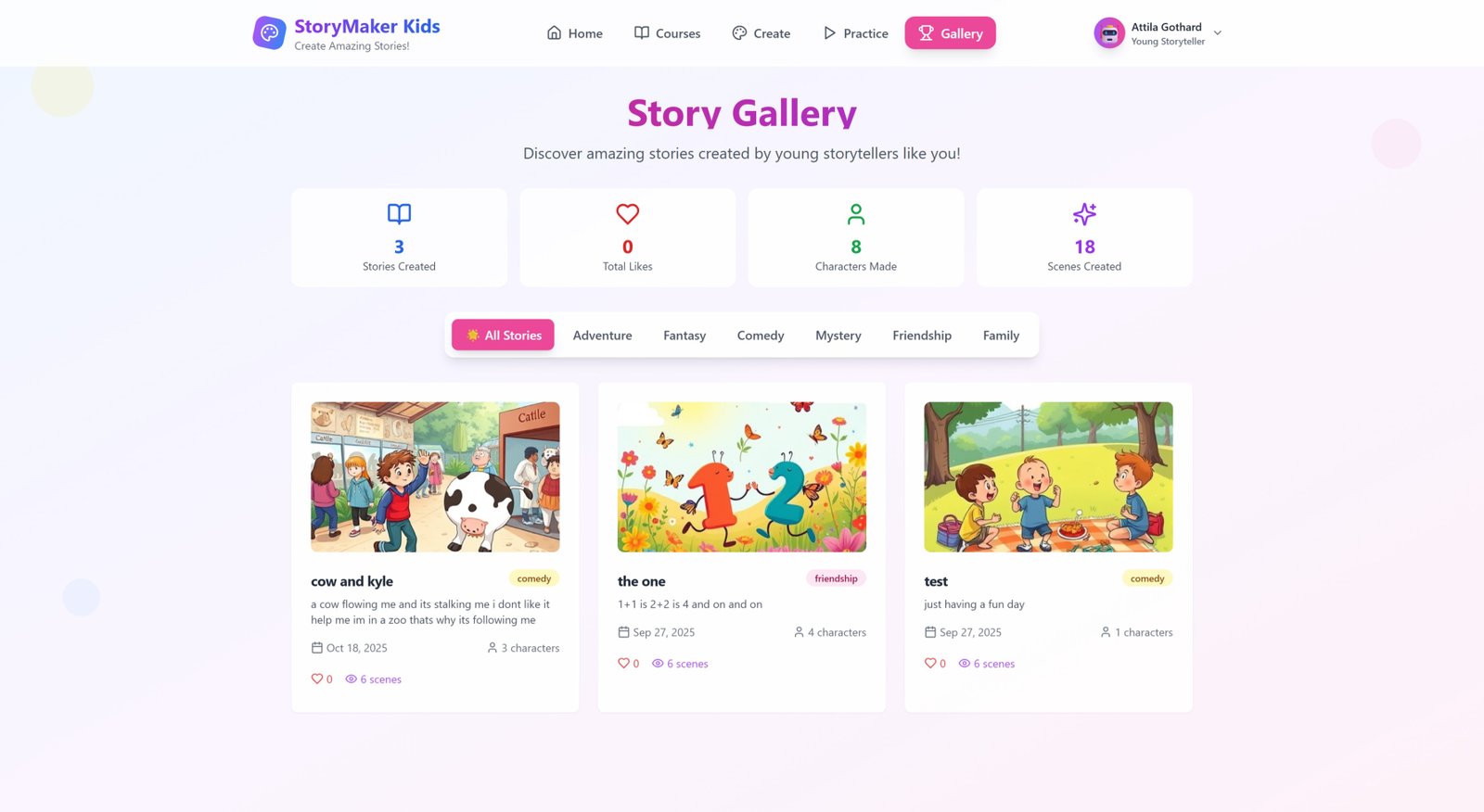

Latin America Wind Turbine Market Growth, Forecast, and Outlook 2026-2034

The Latin America wind turbine market reached a size of 9.6 Gigawatt in 2025. It is projected to expand significantly, reaching 240.5 Gigawatt by 2034, reflecting a robust CAGR of 43.04% during 2026-2034.

Market Overview

The Latin America wind turbine market reached a size of 9.6 Gigawatt in 2025. It is projected to expand significantly, reaching 240.5 Gigawatt by 2034, reflecting a robust CAGR of 43.04% during 2026-2034. This rapid growth is driven by increased investments in renewable energy infrastructure, technological advancements, and cost reductions enhancing wind turbine efficiency and market penetration. The market is further fueled by countries like Brazil, Mexico, Chile, and Argentina focusing on sustainable energy and wind power capacity expansion.

Study Assumption Years

- Base Year: 2025

- Historical Year/Period: 2020-2025

- Forecast Year/Period: 2026-2034

Latin America Wind Turbine Market Key Takeaways

- The market size reached 9.6 Gigawatt in 2025 and is forecast to reach 240.5 Gigawatt by 2034 with a CAGR of 43.04% during 2026-2034.

- Significant investment is being made in renewable energy infrastructure across Latin America, notably by governments supporting wind energy projects.

- Brazil leads the market with major wind power generation increases, particularly in northeastern regions with strong wind resources.

- Mexico is diversifying its energy mix through onshore and offshore wind farms to harness coastal wind resources.

- Technological advancements include developing turbines for lower wind speeds and hybrid wind-solar systems that improve energy reliability.

- Innovations, like Brazil's first Low Voltage Ride Through (LVRT) test, are enhancing grid stability and turbine performance.

Sample Request Link: https://www.imarcgroup.com/latin-america-wind-turbine-market/requestsample

Market Growth Factors

Investment increases in renewable energy infrastructure: Increased investment in renewable energy infrastructure fuels the Latin America wind turbine market. Several Latin American countries are promoting the use of renewable energy sources now. These countries see wind energy infrastructure implementation promoted by regulations that are favorable in nature along with financial incentives. Colbún invests $700 million in Chile into the Horizonte wind farm for it to reach 996 MW by 2025. This happens in Brazil, Mexico, Chile and Argentina in order to meet renewable energy targets, reduce fossil energy dependency and build resilience against climate change impacts. Such government focus is expected to continue and accelerate investments into wind power.

Technology progresses with improvement of technology and reduction in cost to enable growth. Designers improve blades and materials making turbines more efficient and turbines grow larger plus more powerful. This reduces the cost to produce wind power per megawatt (MW) of installed wind-generation capacity. In response, wind turbine developers in Latin America manufacture alternative turbine models for lower wind ranges, and hybrid wind-solar installations can help provide a more reliable energy supply. In Brazil, ENGIE Brasil and WEG operated the country's first grid-connected LVRT test (2.1 MW) which led to a 4.2 MW LVRT turbine to improve grid stabilization and operational performance.

International interest and market growth: Latin American countries showing commitment to reduce carbon emissions, the rising share of non-conventional renewable energy (NCRE) in the energy matrix, and market potential for growth including Brazil pushing wind generation and Mexico seeking to diversify. Meaningful active and planned expansions of wind farms in Brazil's northeast region and Mexico both onshore and offshore, as well as important expansions planned in other major countries like Chile, an increasing cost-competitiveness and technological reliability of the wind power facilities are expected to drive growth and market adoption of wind turbines in Latin America.

Market Segmentation

Location of Deployment Insights:

- Onshore: The market includes onshore wind turbine developments, which are predominant given the strong wind resources in countries like Brazil’s northeast.

- Offshore: Offshore wind farms are also part of the market scope, especially in Mexico, where coastal wind resources are leveraged for energy diversification.

Regional Insights:

- Brazil: Leading country in Latin America for wind power generation with significant expansion in northeastern wind farms.

- Mexico: Diversifying energy mix via onshore and offshore wind farms along coastal areas.

- Argentina, Colombia, Chile, Peru, Others: Included in the regional market analysis, supporting overall market growth through various wind energy projects.

Regional Insights

Brazil dominates the Latin America wind turbine market, evidenced by significant growth in wind power capacity, particularly in the northeast. Mexico is another key region, developing both onshore and offshore wind projects to harness coastal wind resources. The commitment across these regions to renewable energy targets and carbon emission reductions is driving robust market growth, supported by favorable government policies and international investments.

Recent Developments & News

In February 2025, Sudene approved the first installment of R$ 62.6 million for the Borborema II Wind Farm project in Paraíba, Brazil, which includes 21 wind turbines and 123 MW capacity alongside a 30 km transmission line across Pocinhos and Areial. In January 2025, São Paulo Metro signed a 15-year agreement with CGN Brasil and Pontoon Energia to self-produce wind and solar energy at the Lagoa do Barro complex in Piauí, projected to save BRL 12 million annually and reduce CO₂ emissions by over 200,000 tons over the agreement period.

Key Players

- Colbún

- ENGIE Brasil

- WEG

- CGN Brasil

- Pontoon Energia

- Sudene

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

What's Your Reaction?