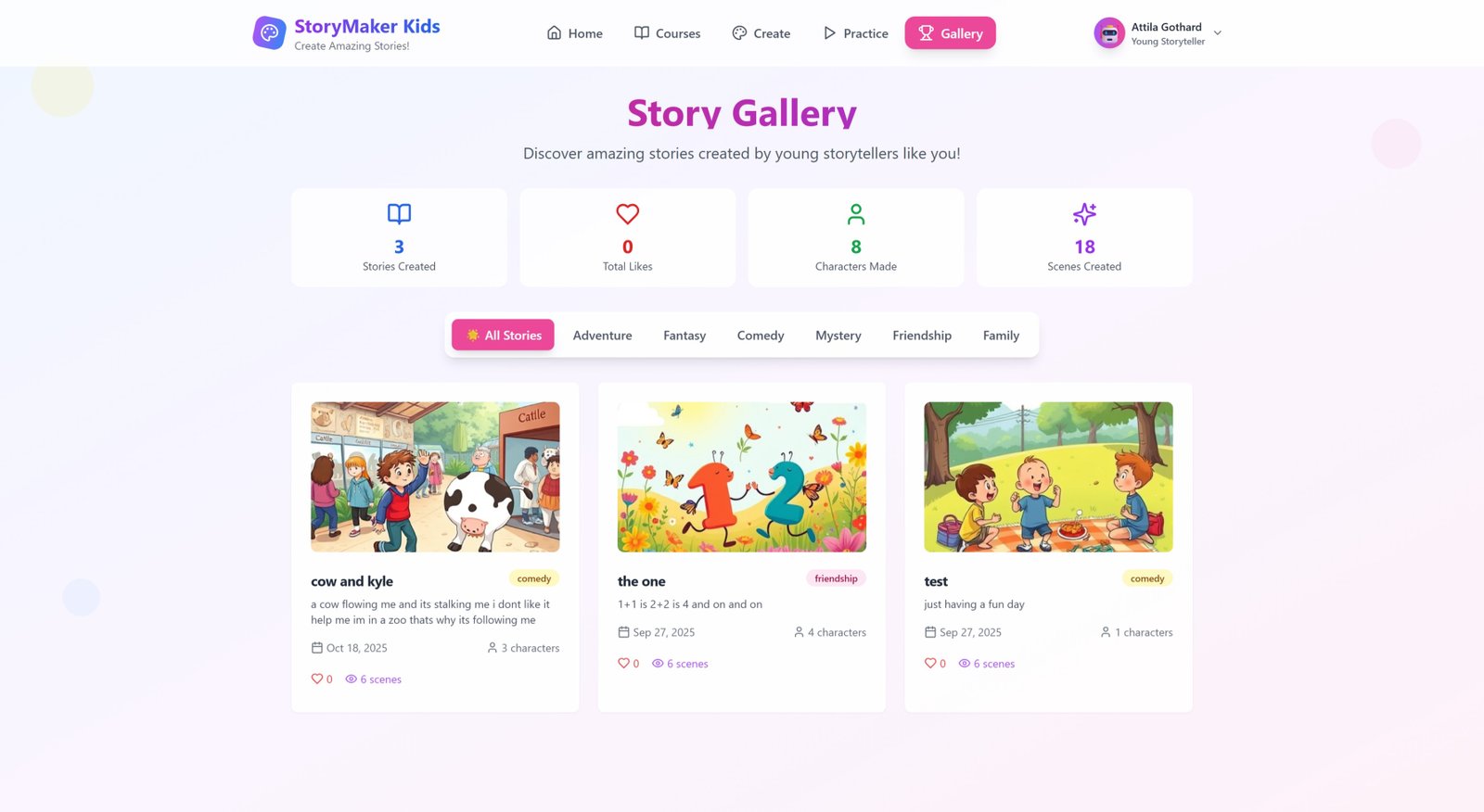

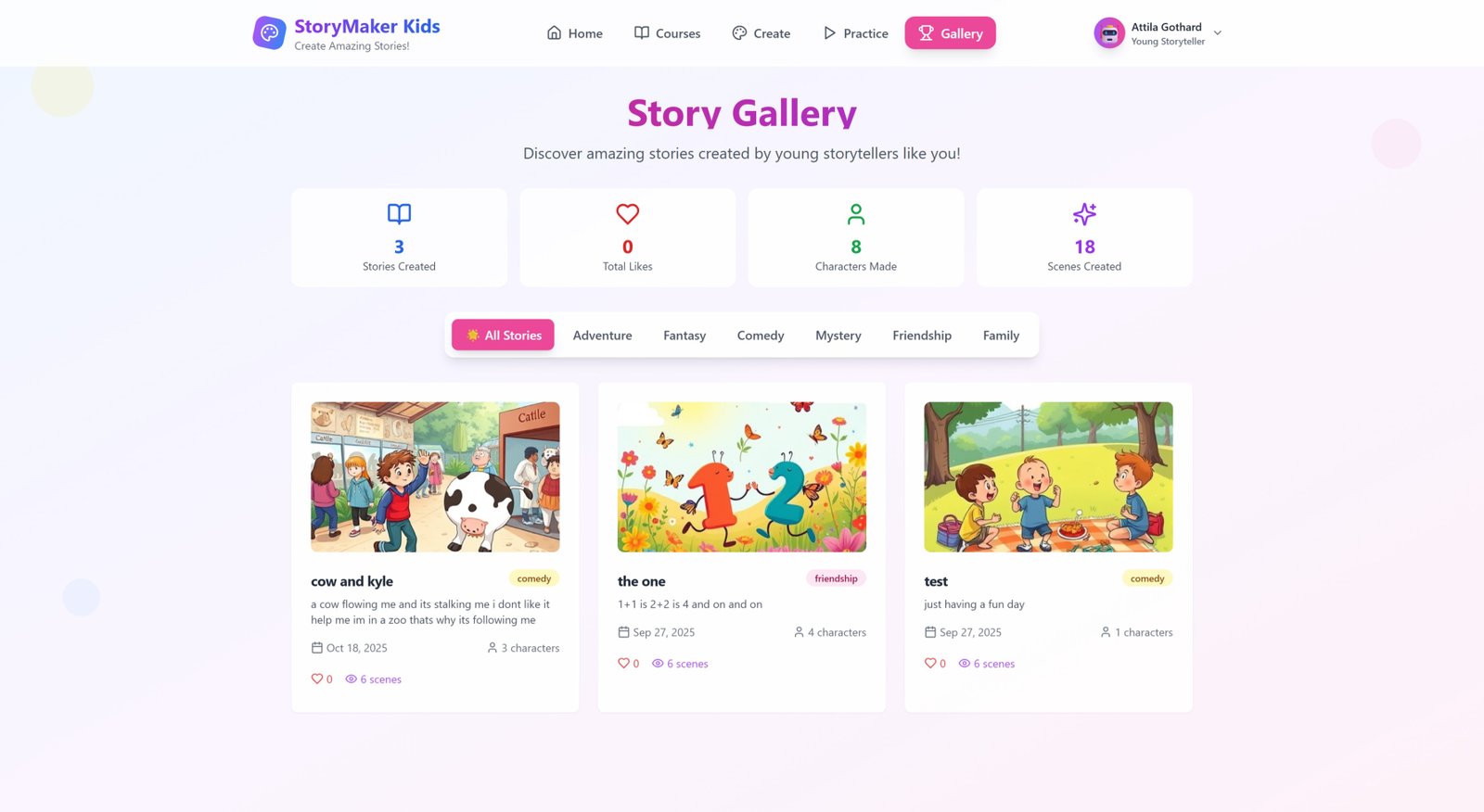

Europe Wine Market Growth Forecast, Share Analysis, and Outlook to 2033

The Europe wine market size was valued at USD 78.5 Billion in 2024 and is projected to reach USD 113 Billion by 2033, exhibiting a CAGR of 4.1% during the forecast period of 2025-2033.

Market Overview

The Europe wine market size was valued at USD 78.5 Billion in 2024 and is projected to reach USD 113 Billion by 2033, exhibiting a CAGR of 4.1% during the forecast period of 2025-2033. The market growth is energized by rising demand for premium, organic, and sustainable wines driven by health-conscious and younger consumers. Technological advances like e-commerce and precision viticulture, alongside evolving consumer preferences and regulatory standards, are enhancing market accessibility and quality.

Study Assumption Years

- Base Year: 2024

- Historical Year/Period: 2019-2024

- Forecast Year/Period: 2025-2033

Europe Wine Market Key Takeaways

- Current Market Size: USD 78.5 Billion in 2024

- CAGR: 4.1% during 2025-2033

- Forecast Period: 2025-2033

- The market is driven by the rising demand for premium, organic, and sustainable wines due to health-conscious and younger consumer groups.

- Climate change is influencing wine production regions and grape varieties.

- Technological advances such as e-commerce and precision viticulture improve wine accessibility and quality.

- Increasing consumer interest in wine tourism and evolving regulatory standards support market growth.

- The wine industry emphasizes sustainability, reducing carbon footprints and adopting organic farming practices.

Sample Request Link: https://www.imarcgroup.com/Europe-Wine-Market/requestsample

Market Growth Factors

The Europe wine market is growing because premium wines are in higher demand in addition to organic and sustainably produced wines. For health, health conscious younger consumers shift more toward buying organic eco-friendly wines. Investment into sustainability initiatives helps European wines appeal to environmentally conscious consumers while developing trust and loyalty globally. These initiatives include reduced carbon footprints. They also include promoting biodiversity, organic and biodynamic growing practices.

Vineyards are changing because of climate change. Varieties can grow in new areas because temperatures are warmer. Customary areas use drought-resistant varieties. Customary areas irrigate with less resource. Customary areas manage canopy size to control both yield and quality. Governments also support climate-resilient business practices with funding climate-related research, subsidizing, and making policies to maintain sustainable industry viability.

Technology develops to improve growth, such as to better manufacture with efficiency and access, and to move to virtual tastings and e-commerce platforms to attract consumers. Precision viticulture, and fermentation innovations including micro-vinification help to improve both yield and quality. Online wine marketplaces use computer programs and technology to attract younger consumers. These innovations allow European wineries to compete within international markets.

Market Segmentation

By Product Type

- Still Wine: Encompassing white, red, and rosé varieties, still wine benefits from regional appellation focus and terroir-driven production. There is growing interest in organic and natural options reflecting a preference for minimally processed beverages.

- Sparkling Wine: Includes champagne, prosecco, and cava, celebrated for luxury and celebrations. Innovations in sweeter and lower-alcohol variants appeal to broader tastes and casual consumption.

- Fortified Wine and Vermouth: Valued for rich flavors and versatility. Port and Sherry maintain strong regional demand, while vermouth’s rise in modern mixology attracts younger consumers.

By Color

- Red Wine: Holds a prominent market position for complex flavor profiles and pairing versatility. The demand is further strengthened by natural and organic variants appealing to health and eco-conscious consumers.

- Rose Wine: Growing in popularity for its light, refreshing nature and visual appeal. Its seasonal versatility caters to casual and formal occasions.

- White Wine: Celebrated for crisp, aromatic qualities and food pairing suitability. It appeals to broad palates with diverse sweetness levels and styles, including lower-alcohol and sustainably produced options.

By Distribution Channel

- Off-Trade: Includes retail stores, supermarkets, and online websites. It dominates wine sales due to competitive pricing, convenience, and varied options. E-commerce is expanding, offering curated assortments and subscription services.

- On-Trade: Comprises restaurants, bars, hotels, and tasting rooms. It thrives on experiential consumption, sommelier expertise, curated wine lists, and seasonal or event-driven demand.

Regional Insights

Germany, France, the United Kingdom, Italy, and Spain are key markets in Europe’s wine industry. Germany favors domestic and imported wines with strong white wine traditions and sustainability interests. France leads as a major producer with a blend of tradition and modern innovation, emphasizing quality and export demand. The UK is largely import-driven, with rising interest in sparkling wines and local varieties. Italy focuses on regional varietals and sustainability to support domestic consumption and exports. Spain is known for affordable, quality wines with growing organic options. Together, these regions exemplify Europe’s diverse and robust wine market.

Recent Developments & News

In October 2024, Merenda, a Southern European bistro and wine bar, announced its opening in Oceanside, offering Mediterranean dishes alongside sustainable wines. In September 2024, Europe launched the VITÆVINO campaign to honor and protect wine culture, advocating responsible consumption and sustainability. In June 2024, Accolade Wines introduced its premium Remastered series in travel retail, featuring Italian Sangiovese and Fiano wines priced at £10, aiming to attract younger consumers with a modern take on tradition.

Key Players

- Accolade Wines

- Pernod Ricard SA

- Treasury Wine Estates Ltd

- Rotkäppchen-Mumm Sektkellereien GmbH

- GCF Group

- Constellation Brands, Inc.

- E. & J. Gallo Winery

- Castel Group (Baron de Lestac)

- Louis Roederer

- Financière Pinault SCA (Groupe Artemis SA)

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

What's Your Reaction?