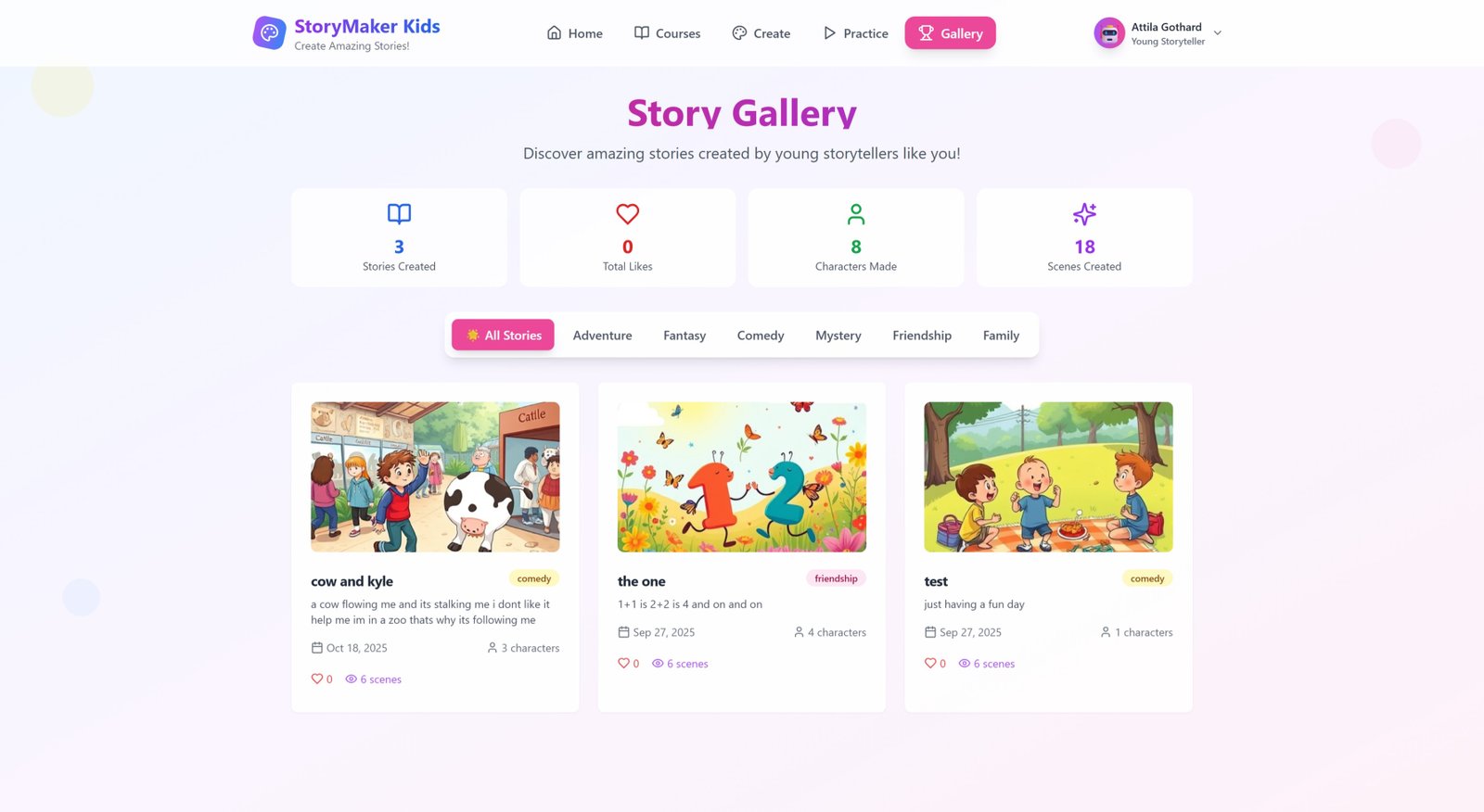

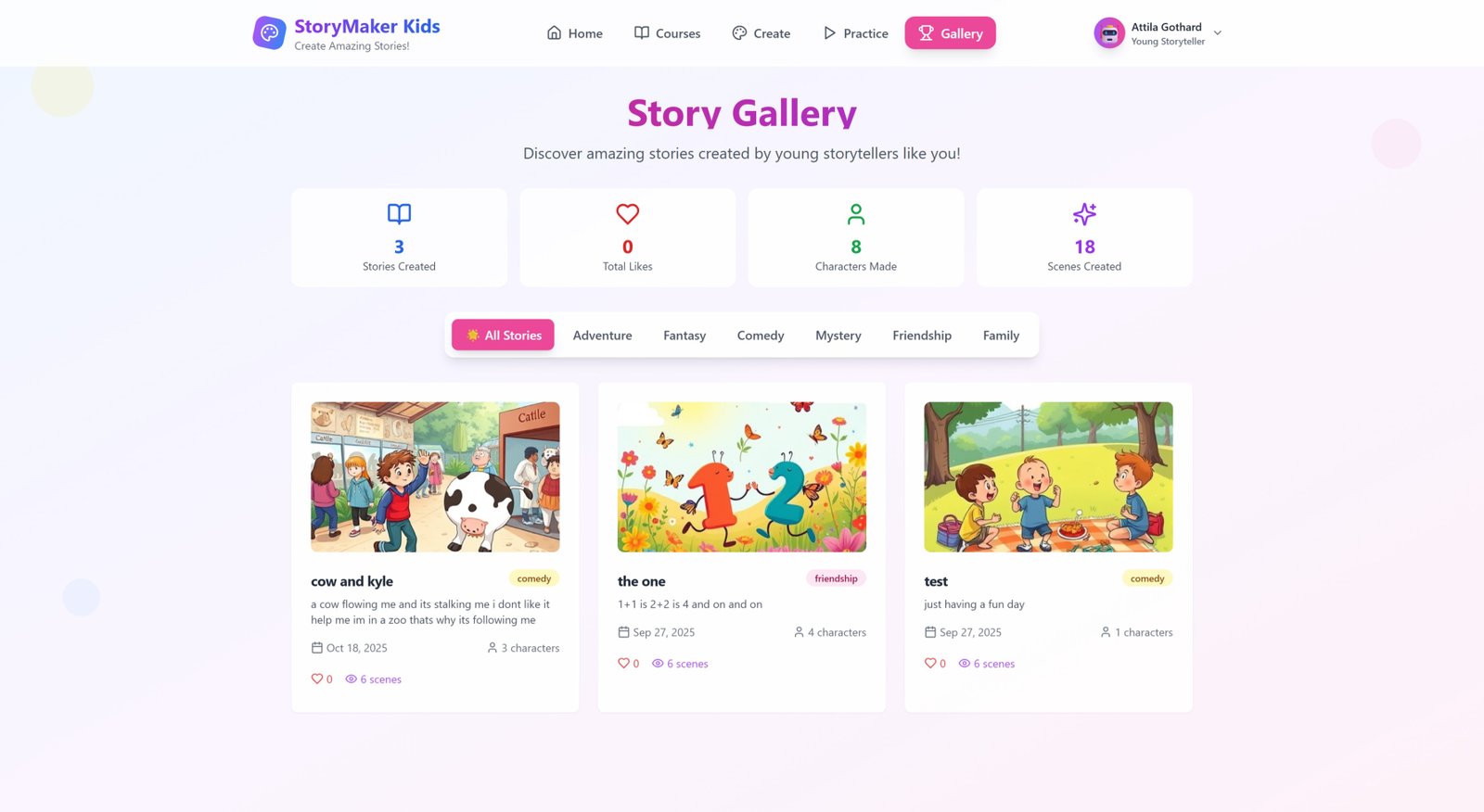

Europe Textile Market Growth, Share Analysis, and Forecast Report to 2033

The Europe textile market was valued at USD 261.7 Billion in 2024 and is projected to reach USD 409.4 Billion by 2033, exhibiting a CAGR of 4.6% during the forecast period 2025-2033. Germany holds the largest share, accounting for over 20.7% in 2024.

Market Overview

The Europe textile market was valued at USD 261.7 Billion in 2024 and is projected to reach USD 409.4 Billion by 2033, exhibiting a CAGR of 4.6% during the forecast period 2025-2033. Germany holds the largest share, accounting for over 20.7% in 2024. Growth drivers include rising demand for sustainable textiles, technological advancements, and strong fashion and home furnishing industries.

Study Assumption Years

- Base Year: 2024

- Historical Year/Period: 2019-2024

- Forecast Year/Period: 2025-2033

Europe Textile Market Key Takeaways

- The Europe textile market size is valued at USD 261.7 Billion in 2024.

- The market is projected to grow at a CAGR of 4.6% during 2025-2033.

- The forecast period for the market is 2025-2033.

- Germany leads the market with a share of over 20.7% in 2024, driven by a robust manufacturing base and technological advances.

- Rising consumer demand for sustainable textiles and eco-friendly manufacturing is a key growth driver.

- Technological innovations such as digital printing and automated production enhance production efficiency.

- The demand for luxury and technical textiles in fashion, automotive, healthcare, and construction is increasing.

Sample Request Link: https://www.imarcgroup.com/Europe-Textile-Market/requestsample

Market Growth Factors

The Europe textile market is rapidly expanding due to the increasing consumer preference for sustainable and eco-friendly textiles. Manufacturers are innovating with organic and recycled materials, supported by eco-friendly initiatives such as the launch of Syre by Vargas and H&M Group in March 2024, which aims to reduce CO2e emissions by 85% through textile-to-textile recycling starting with polyester. The European Union's regulatory framework further promotes sustainable textile manufacturing, catalyzing market growth.

Technological advancements significantly enhance production efficiency and product quality. April 2024 saw Getzner Textil launch advanced technical textiles including PPE fabrics and sustainable materials using 3D technology. Digital textile printing and automated machinery reduce costs and improve turnaround times, while AI and IoT enable real-time monitoring and predictive maintenance. Smart textiles with sensors and features like antimicrobial coatings support new applications and durability, fostering investments in the region.

The demand for luxury and technical textiles is growing across fashion, interior design, automotive, healthcare, and construction sectors due to their superior quality and specialized functionalities. Technical textiles provide strength, insulation, and antibacterial properties for industrial uses. Smart textiles integrating sensors enhance clothing and medical devices. This diversification, along with innovation and customization, boosts market competitiveness and size in Europe.

Market Segmentation

Analysis by Raw Material

Cotton

A breathable, versatile natural fiber used in apparel, home furnishings, and industrial products. Its biodegradable nature appeals to eco-conscious markets.

Chemical

Includes synthetic and regenerated fibers like polyester, nylon, and viscose, valued for durability and affordability across apparel, home textiles, and technical uses.

Wool

A warm, resilient natural fiber favored for winter apparel, upholstery, and luxury items due to its moisture-wicking and insulating properties.

Silk

A luxury natural fiber known for shine, smooth texture, and strength, used in premium apparel, accessories, and home decor.

Others

Comprise flax, hemp, jute, and bio-based fibers, gaining traction for their eco-friendly and versatile attributes used in fashion, home textiles, and industrial sectors.

Analysis by Product

Natural Fibers

Include wool, silk, and cotton, prized for eco-friendliness and biodegradability, used in sustainable textiles for apparel, home furnishings, and industrial applications.

Polyesters

Synthetic fibers valued for durability, wrinkle resistance, and cost-effectiveness, widely used in fashion, upholstery, and industrial textiles.

Nylon

A flexible, strong synthetic fiber applied in durable textiles like sportswear, hosiery, and technical industrial fabrics.

Others

Regenerated fibers such as viscose and bio-based or recycled textiles, valued for sustainability and innovation across fashion, home textiles, and technical applications.

Analysis by Application

Household

Textiles like bed linens, curtains, and upholstery, driven by consumer priorities for comfort, design, and sustainability.

Technical

Specialized textiles for industrial, medical, and safety applications offering durability, heat resistance, and filtration, used in automotive, healthcare, and construction sectors.

Fashion and Clothing

Dominated by cotton, wool, and synthetics, influenced by fashion trends, seasonal demands, and advancing sustainable and smart textile innovations.

Others

Include automotive interiors, medical devices, agriculture textiles, and specialty products such as non-woven fabrics and geotextiles.

Regional Insights

Germany dominates the Europe textile market, commanding over 20.7% market share in 2024. This leadership is attributed to its strong manufacturing base, advances in technology, and demand for traditional and technical textiles. Germany's emphasis on innovation, sustainability, and efficient production processes secures its competitive edge globally.

Recent Developments & News

In October 2024, Reju inaugurated Regeneration Hub Zero in Frankfurt, the first textile-to-textile recycling facility focusing on polyester and reducing carbon footprint by 50%. In September 2024, The Filament Factory launched a high-strength PA12 multifilament yarn developed with Evonik for automotive, aviation, and sports applications. July 2024 saw Lenzing Group lead the CELLFIL project funded by the EU to scale sustainable lyocell filaments. In January 2024, BASF and Inditex introduced loopamid®, a circular nylon 6 made from textile waste, incorporated by Zara into jackets to promote circularity in fashion.

Key Players

- Syre

- Vargas

- H&M Group

- Myant Corp.

- Nanoleq

- Osmotex

- Reju

- The Filament Factory (TFF)

- Evonik

- Lenzing Group

- BASF

- Inditex

- Zara

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

What's Your Reaction?