What are the Different Types of FinTech Apps and Their Average Cost

Explore the different types of FinTech apps—from digital banking to PFM—and learn their average development costs to better plan your next financial product.

FinTech is fundamentally changing the way we think about and do finance all over the world, and for businesses, it opens up huge possibilities. Understanding the different types of FinTech applications available will help you make better choices if you're a CEO thinking about launching a new digital product or a business looking for new ways to solve its financial issues. Our blog will provide you with a simple overview of the FinTech app development cost, along with clarity on how to move ahead.

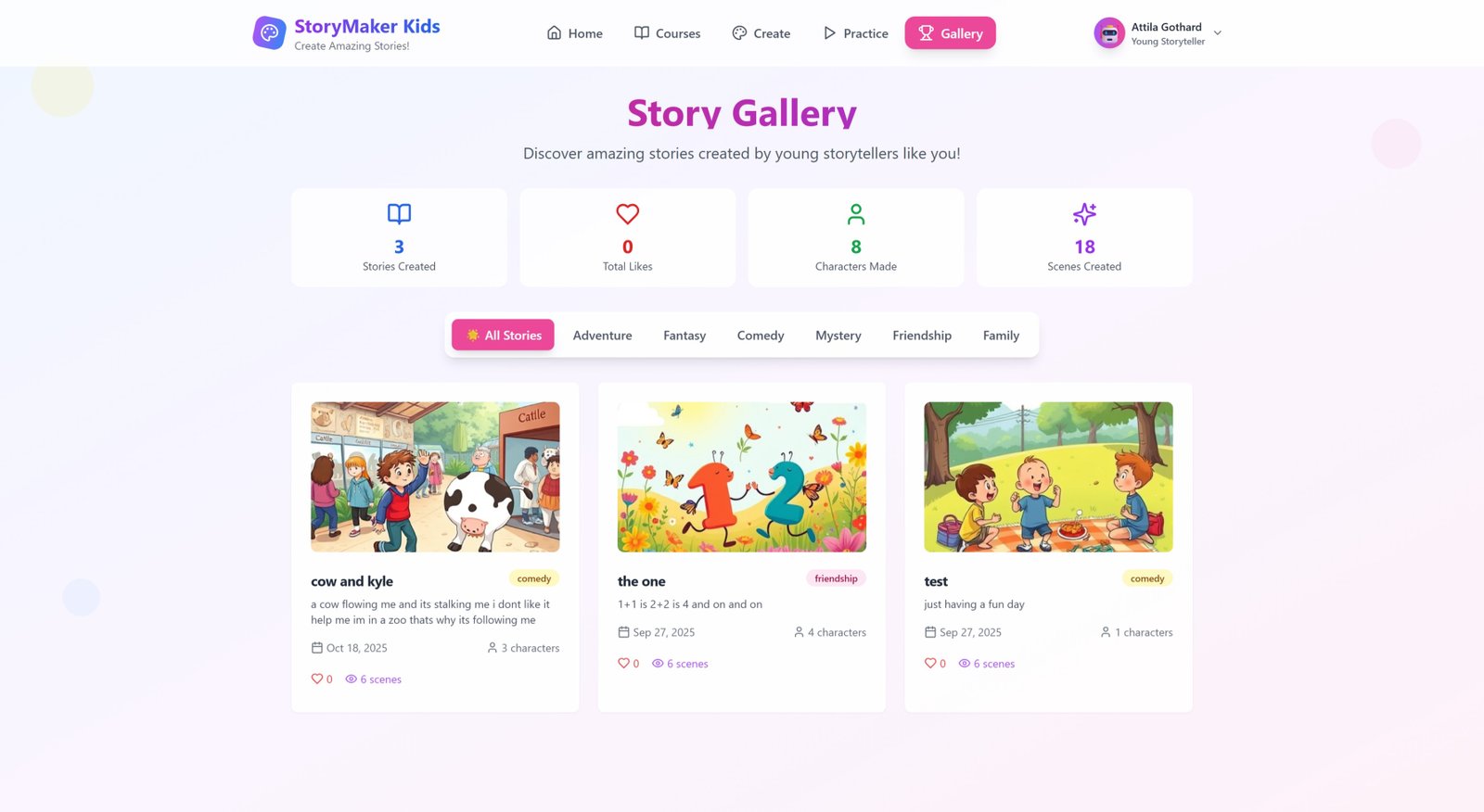

List of FinTech App Types

1. Digital Banking Apps

Digital banking platforms have become the new normal. They offer users a convenient, seamless way to manage money without stepping into a branch.

What They Usually Include

-

Fast onboarding & eKYC

-

Money transfers

-

Virtual debit cards

-

Bill payments

-

Account insights

Average Cost

$60,000 – $250,000+

Security, compliance, and advanced features like multi-currency accounts largely determine where your budget lands.

2. Payment & Money Transfer Apps

From mobile wallets to P2P transfers, payment apps handle high-volume transactions with speed and reliability.

Core Features

-

QR payments

-

Wallet functionality

-

Integration with payment gateways

-

Transaction history

-

Instant settlements

Average Cost

$40,000 – $200,000+

Compliance standards (PCI DSS, AML), data encryption, and large-scale transaction handling impact cost significantly.

3. Investment & Wealth Management Apps

As more users shift toward digital trading and passive investing, these platforms continue to gain traction.

Key Highlights

-

Portfolio tracking

-

Robo-advisory tools

-

Market analytics

-

Stock/ETF buying

-

Automated strategies

Average Cost

$70,000 – $300,000+

Integrations with brokerage services and complex algorithmic engines naturally increase the price tag.

4. InsurTech Apps

InsurTech solutions modernize the traditionally slow insurance sector by automating paperwork and claims processes.

Common Features

-

Compare policies

-

File claims instantly

-

Premium calculators

-

Risk assessment tools

-

24/7 support

Average Cost

$50,000 – $250,000+

AI-driven underwriting or predictive analytics tends to push costs upward.

5. Lending & Credit Apps

These apps help users and businesses access credit faster—with automated approval workflows and transparent repayment systems.

Popular Features

-

Digital loan applications

-

Credit scoring

-

Repayment tracking

-

KYC verification

-

EMI calculators

Average Cost

$60,000 – $200,000+

Building custom credit-risk models or alternative scoring systems increases development complexity.

6. RegTech Apps

RegTech solutions help organizations stay compliant in an ever-changing regulatory environment—a growing concern across global markets.

Core Capabilities

-

Identity verification

-

Fraud monitoring

-

Compliance dashboards

-

Automated reporting

-

AML tools

Average Cost

$80,000 – $300,000+

Compliance-heavy apps require advanced security architecture, making them one of the more expensive categories.

7. Personal Finance Management (PFM) Apps

PFM tools empower users to take control of their money with smart budgeting and financial insights.

Useful Features

-

Expense tracking

-

Budget creation

-

Savings recommendations

-

Goal management

-

Bank account integrations

Average Cost

$30,000 – $150,000+

The cost varies depending on how much automation and analytics you want to offer.

What Affects the Cost of Building a FinTech App?

No matter the category, a few core factors influence overall investment:

-

Security & Compliance: Encryption, audits, and adherence to regulations

-

Feature Set: Simpler apps cost less; AI/ML or blockchain adds a premium cost

-

UI/UX: Financial apps need intuitive, trust-building designs

-

Integrations: Banking APIs, payment processors, and data providers

-

Platforms: Android, iOS, Web, or a combined approach

Leveraging expert FinTech application development services helps you optimize these areas while controlling cost and ensuring reliability.

In The End

To stay competitive within their own industry and increase profit margins, business owners looking to make improvements to their digital strategy should focus on developing a secure FinTech application. Also, understanding the types of apps available and estimating their FinTech app development cost will allow them to create a better business case for investment.

Depending upon which type of Application you would like to create (Payment Application, PFM Application, or Full-scale Digital Banking Solution), you must partner with a reliable FinTech application development services provider to securely and quickly develop the application while complying with industry regulations, as well as being able to provide improved long-term returns on your Investment.

What's Your Reaction?