Latin America Fintech Market Share Analysis, Trends, and Growth Outlook 2026

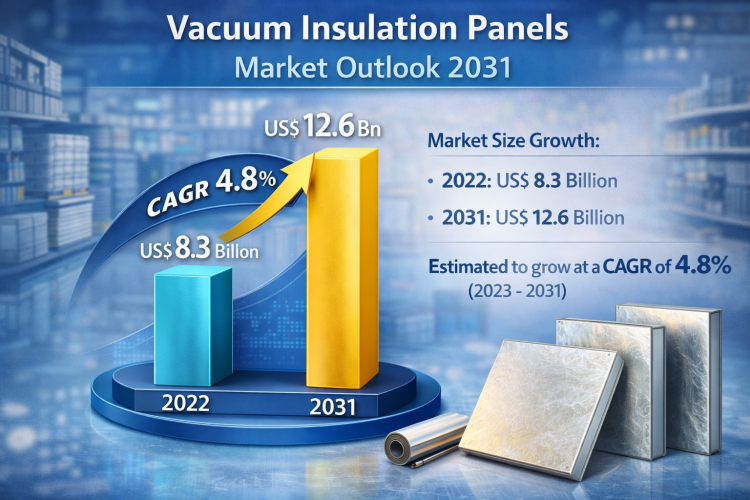

The Latin America fintech market size reached USD 15.2 Billion in 2025 and is projected to expand to USD 54.0 Billion by 2034. The market is expected to grow at a CAGR of 15.11% during the forecast period 2026-2034.

Market Overview

The Latin America fintech market size reached USD 15.2 Billion in 2025 and is projected to expand to USD 54.0 Billion by 2034. The market is expected to grow at a CAGR of 15.11% during the forecast period 2026-2034. This growth is driven by increasing digital banking adoption, widespread smartphone use, and supportive open banking regulations. The rapid expansion of fintech startups and enhanced financial inclusion efforts make the Latin America Fintech Market a fast-growing sector in the region.

Study Assumption Years

- Base Year: 2025

- Historical Years: 2020-2025

- Forecast Period: 2026-2034

Latin America Fintech Market Key Takeaways

- The fintech market in Latin America reached USD 15.2 Billion in 2025.

- The market is projected to exhibit a CAGR of 15.11% during the forecast period 2026-2034.

- The market is expected to reach USD 54.0 Billion by 2034.

- The number of fintech startups in Latin America and the Caribbean grew by over 340% from 703 in 18 countries in 2017 to 3,069 in 26 countries by 2023.

- Digital banking adoption and smartphone penetration are major growth drivers.

- Neobanks and digital wallets have expanded rapidly, transforming financial services.

- Governments' promotion of open banking frameworks fosters financial access and competition.

Sample Request Link: https://www.imarcgroup.com/latin-america-fintech-market/requestsample

Market Growth Factors

The fintech market in Latin America has seen rapid growth as a result of the greater adoption of digital banking services, linked to financial inclusion schemes or rising smartphone penetration. For example, Brazil's central bank says the return on equity of digital banks went from 11.45% in December 2023 to 19.1% in June 2024, as opposed to the customary banking industry. The increase is partly due to the economies of scale in provisioning and the improved efficiency of digital banks like C6 Bank, Banco Inter, and Nubank, as well as the high demand for easy-to-use, digital financial ecosystems, opening up financial services to the unbanked and underbanked.

Cryptocurrency and blockchain-based financial services have been adopted in Brazil, Argentina, and Mexico to reduce inflation and currency depreciation. Crypto is particularly used for remittances, savings, and payments in markets in Latin America. In Brazil, the central bank says stablecoins represent nearly 90% of crypto flows, mainly for cross-border payments. Blockchain can also lower costs and improve security for remittances, smart contracts, and decentralized lending and borrowing platforms, among others.

Emergence of neo-banks and digital wallets as a low-risk, transparent, and low-friction entry point for the younger, more tech-savvy and unbanked consumers in Latin America. Digital wallets incorporating mobile and QR payments have transformed the markets in Brazil, Mexico and Colombia. The pandemic expedited the move to cashless payments, with fintechs Nubank, Mercado Pago, and Ual\u00e1 reaching millions of users and pushing customary banks to upgrade their infrastructure. Generous legal environment and cellphone saturation may further accelerate the fintech market in the future.

Market Segmentation

Deployment Insights:

- On-premises

- Cloud Based

These segments include deployments on in-house infrastructure and cloud platforms.

Technology Insights:

- Application Programming Interface

- Artificial Intelligence

- Blockchain

- Robotic Process Automation

- Data Analytics

- Others

The market uses diverse technologies such as APIs, AI, blockchain, RPA, and data analytics for fintech solutions.

Application Insights:

- Payment and Fund Transfer

- Loans

- Insurance and Personal Finance

- Wealth Management

- Others

The applications include services for payments, credit, insurance, wealth, and additional financial services.

End User Insights:

- Banking

- Insurance

- Security

- Others

End users of fintech services include banking institutions, insurance firms, security sectors, and others.

Regional Insights

Brazil, Mexico, Argentina, Colombia, Chile, and Peru are the key regional markets analyzed for the Latin America fintech industry. Brazil stands out as a dominant region with significant fintech activity, including advances in digital banking profitability and blockchain initiatives. The market growth rate during 2026-2034 is projected at 15.11%, contributing to Brazil’s role as a major hub in Latin America's fintech expansion.

Recent Developments & News

In July 2025, Thredd partnered with Puerto Rico-based Payblr to combine modular payments technology with cross-border issuing expertise, facilitating fintech expansion in Latin America and the Caribbean. In April 2025, Nu Holdings, parent company of Nubank, expanded across Mexico, Brazil, and other markets, promoting accessible tech-driven banking despite regulatory challenges. March 2025 saw Prometeo launching its Borderless Banking platform, enabling integrated banking operations between the US and Latin America with real-time transaction tracking. Brazilian fintech Juca expanded to over 3,000 points of sale in February 2025, offering FGTS Advance loans via integrable APIs. In December 2024, Fiserv, Inc. introduced Clover, Brazil’s first multi-acquirer ecosystem, providing comprehensive payment solutions to local businesses.

Key Players

- Nubank

- Mercado Pago

- Ualá

- C6 Bank

- Banco Inter

- Juca

- Thredd

- Payblr

- Nu Holdings

- Prometeo

- Fiserv, Inc.

Customization Note

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

What's Your Reaction?