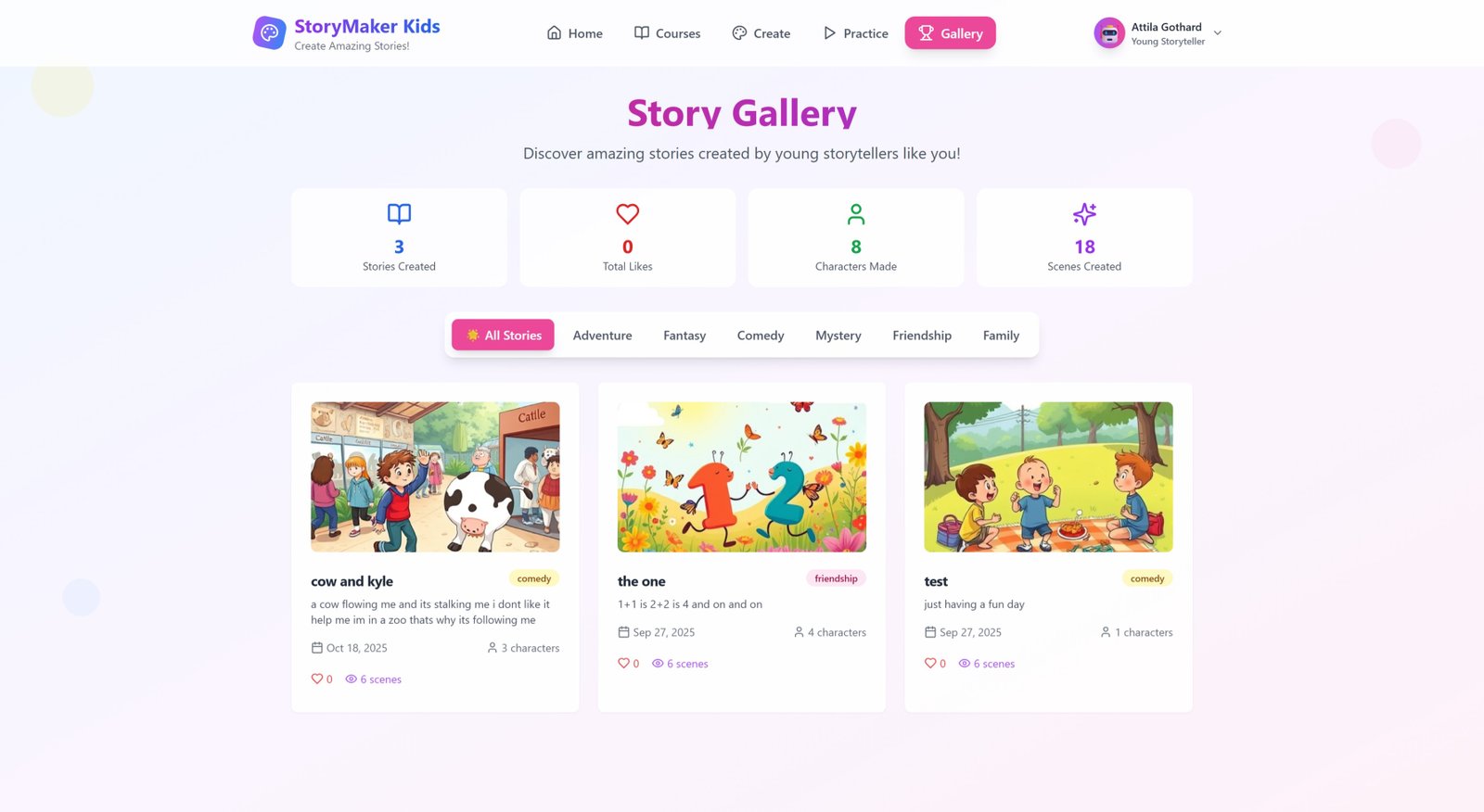

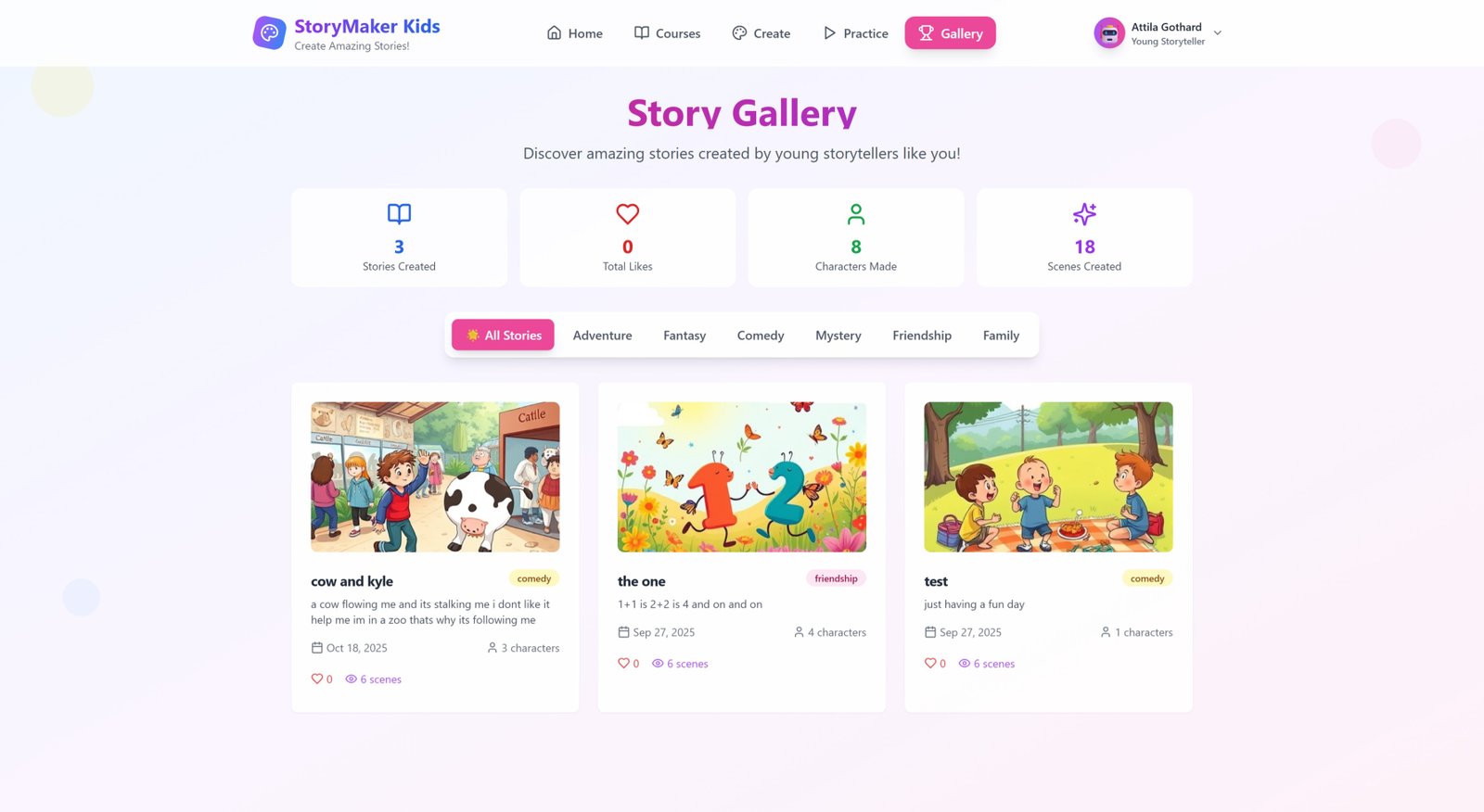

Germany Insurtech Market Share, Analysis Report, and Outlook to 2033

The Germany Insurtech Market size reached USD 728.00 Million in 2024 and is projected to grow to USD 6,513.70 Million by 2033, expanding at a CAGR of 24.50% during the forecast period of 2025-2033.

Market Overview

The Germany Insurtech Market size reached USD 728.00 Million in 2024 and is projected to grow to USD 6,513.70 Million by 2033, expanding at a CAGR of 24.50% during the forecast period of 2025-2033. This growth is driven by increasing reliance on digital tools for data collection and analysis, enabling customized insurance solutions and user-friendly digital platforms enhancing customer experience.

Study Assumption Years

- Base Year: 2024

- Historical Years: 2019-2024

- Forecast Period: 2025-2033

Germany Insurtech Market Key Takeaways

- The market size was USD 728.00 Million in 2024.

- The market is expected to grow at a CAGR of 24.50% from 2025 to 2033.

- Forecasted market size in 2033 is USD 6,513.70 Million.

- The growing use of digital platforms with user-friendly interfaces is a key market driver.

- Insurtech companies are leveraging machine learning for personalized insurance proposals.

- Usage-based insurance models and telematics devices contribute to market expansion.

- New insurance products such as cyber and travel insurance cater to emerging customer needs.

Sample Request Link: https://www.imarcgroup.com/germany-insurtech-market/requestsample

Market Growth Factors

In part, the insurtech industry in Germany is driven by a substantial investment in digitalization. The European Union's Next Generation Organization (NGEU) funded digitalization in Europe with EUR 117 Billion (USD 122.55 Billion) total and Germany received EUR 12 Billion (USD 12.57 Billion). This has helped people adopt digital insurance solutions faster through collection and analysis of large amounts of customer data by insurers to personalize coverage.

Insurtechs use machine learning to customize insurance offerings according to user data, improving underwriting and customer experience. Mobile apps and websites are utilized for policy management, claim filing, and quote comparison. This improves customer experience and retention in the process. Automated underwriting, claims processing, and customer service reduce operating costs, improve services, and increase market share.

Usage-based insurance premiums depend on how much and how well a policyholder uses a product or service. Telematics tracks driving habits in automobile insurance to match rates to risk profiles and reward safe driving. Gig economy workers or other users who prefer shorter duration insurance products account for some of the demand. Advances in big data and predictive analytics improve risk evaluation, pricing, and underwriting accuracy for potentially expanding the market for on-demand insurance.

Market Segmentation

Type Insights

- Auto: This segment involves insurtech solutions focused on automotive insurance, leveraging telematics and digital platforms for personalized pricing and policy management.

- Business: Encompasses digital insurance solutions tailored for commercial enterprises, incorporating underwriting automation and risk analytics.

- Health: Covers insurtech products customized for healthcare insurance, using big data to tailor coverage.

- Home: Focuses on digital home insurance offerings that simplify claims and policy handling via user-friendly interfaces.

- Specialty: Includes niche insurance products like pet and cyber insurance catering to specific customer segments.

- Travel: Pertains to travel insurance services, including coverage for pandemic-related risks and flexible activation.

- Others: Contains additional insurance types addressed by insurtechs adapting to diverse client needs.

Service Insights

- Consulting: Provides expert guidance for digital transformation and market entry strategies within the insurtech sector.

- Support and Maintenance: Encompasses ongoing technical and operational support to maintain insurtech platforms and services.

- Managed Services: Involves outsourced management of specific insurance processes, including claims and underwriting.

Technology Insights

- Block Chain: Employed to enhance security and transparency in insurance transactions and data handling.

- Cloud Computing: Facilitates scalable and flexible infrastructure for insurtech applications.

- IoT: Internet of Things devices collect real-time data to inform usage-based insurance models.

- Machine Learning: Drives personalized insurance proposals and predictive analytics for risk assessment.

- Robo Advisory: Automated advisory systems assist customers with insurance decisions based on data analysis.

- Others: Other emerging technologies supporting insurtech innovations.

Regional Insights

The Germany Insurtech Market includes analysis of Western Germany, Southern Germany, Eastern Germany, and Northern Germany. Though specific statistics are not detailed, these major regions collectively contribute to the overall market growth, leveraging Germany's significant investments in digital transformation and technological advancements.

Recent Developments & News

In October 2023, Adacta, a leading insurance solutions provider, expanded its operations in Germany to strengthen support for local clients by offering cloud-based solutions that aid digital transformation. In June 2024, Germany-based cyber insurer Cogitanda expanded its services to larger corporates within Germany and Austria, reinforcing its leadership in the cyber-risk sector.

Key Players

- Coalition Insurance Solutions GmbH

- Adacta

- Cogitanda

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

What's Your Reaction?