Europe E-Bike Market Trends, Share Analysis, and Growth Outlook 2025-2033

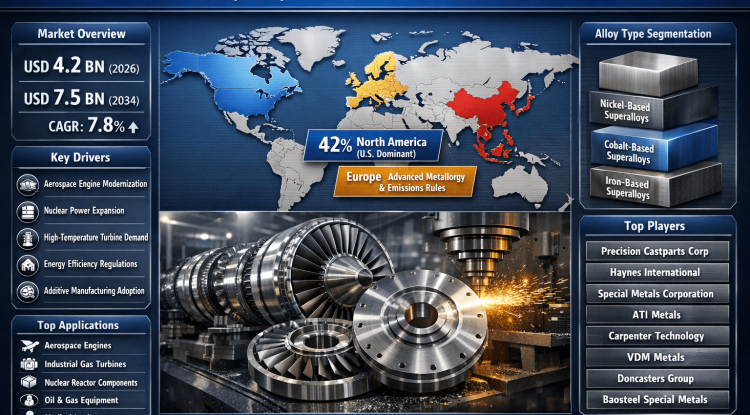

The Europe e-bike market was valued at USD 6,056 Million in 2024. It is projected to grow to USD 10,441.2 Million by 2033, achieving a CAGR of 6.2% from 2025 to 2033.

The Europe e-bike market was valued at USD 6,056 Million in 2024. It is projected to grow to USD 10,441.2 Million by 2033, achieving a CAGR of 6.2% from 2025 to 2033. This growth is driven by rising pollution levels prompting demand for sustainable transportation, government incentives promoting eco-friendly mobility, and technological progress in batteries and motors.

Study Assumption Years

- Base Year: 2024

- Historical Years: 2019-2024

- Forecast Period: 2025-2033

Europe E-Bike Market Key Takeaways

- The market size in 2024 was USD 6,056 Million.

- A CAGR of 6.2% is anticipated during the forecast period from 2025 to 2033.

- The forecast market value is estimated to reach USD 10,441.2 Million by 2033.

- Rapid urbanization and increasing traffic congestion are important growth drivers.

- Rising environmental consciousness and emphasis on health and fitness propel market demand.

- Technological improvements in battery life and motor efficiency increase consumer adoption.

- Favorable government incentives and subsidies further encourage e-bike purchases.

Sample Request Link: https://www.imarcgroup.com/Europe-E-Bike-Market/requestsample

Market Growth Factors

The Europe e-bike market benefits significantly from rapid urbanization and increasing traffic congestion. These trends heighten demand for alternative modes of transport that ease urban mobility challenges. The rise in environmental consciousness and health and fitness awareness among consumers is pushing the adoption of e-bikes. This sector's growth is underpinned by continuous advancements in battery life, motor efficiency, and innovative e-bike designs that meet consumer needs.

Government incentives across Europe form a crucial pillar for the market’s growth. Many countries offer subsidies, tax breaks, and grants to promote e-bike adoption. For example, the French government provides discounts between €300 and €2000, depending on financial status, to reduce the effective cost. UK's government campaigns to improve safety and awareness, and various policies supporting green mobility also stimulate demand.

Infrastructure development is another critical growth factor. Enhanced cycling lanes, public e-bike charging stations, and new laws mandating fast charging facilities on motorways contribute positively. Germany’s expansion of bike lanes, backed by substantial EU funding, and partnerships providing access to extensive charging networks facilitate safer and more accessible usage of e-bikes, encouraging increased market penetration.

Market Segmentation

Mode

- Throttle

- Pedal Assist

Pedal assist dominates, requiring rider pedaling for motor engagement, offering easier rides especially on inclines, favored by commuters and fitness enthusiasts.

Motor Type

- Hub Motor

- Mid Drive

- Others

Hub motors lead the market, integrated into wheel hubs for direct drive, ideal for casual urban riders due to affordability and ease of maintenance.

Battery Type

- Lead Acid

- Lithium Ion

- Nickel-Metal Hydride (NiMH)

- Others

Lead acid batteries are the most used, preferred for affordability in budget e-bikes, while lithium-ion batteries are popular for higher energy density and lifespan.

Class

- Class I

- Class II

- Class III

Class I e-bikes are most prevalent; they assist only while pedaling and limit assistance speed to around 20 mph (32 kph), aligning with European regulations.

Design

- Foldable

- Non-Foldable

Non-foldable e-bikes dominate, representing traditional designs catering to diverse riding styles and user profiles.

Application

- Mountain/Trekking Bikes

- City/Urban

- Cargo

- Others

City/urban e-bikes are the leading segment, designed for daily commuting on paved roads, preferred due to urbanization and sustainability trends.

Country

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

Germany commands the largest market share, supported by strong cycling culture, advanced infrastructure, and extensive government incentives.

Regional Insights

Germany holds the largest share in the Europe e-bike market, driven by its comprehensive bike-friendly policies, substantial government incentives such as subsidies and tax breaks, and a robust cycling culture. The country’s established infrastructure and strong consumer interest position it as a dominant regional market for e-bikes.

Recent Developments & News

In May 2024, Decathlon launched the Van Rysel E-GRVL AF MD, a non-foldable e-gravel bike equipped with carbon forks, Michelin tires, and Bluetooth connectivity. March 2024 saw Himiway introduce the A7 Pro e-bike targeted at urban commuters in Europe. Additionally, CityQ, a German startup, announced plans to launch car-like e-bikes for cargo and passenger use, further expanding product diversity and market reach.

Key Players

- Giant Manufacturing Co. Ltd.

- Kalkhoff Werke GmbH

- Riese & Müller GmbH

- Trek Bicycle Corporation

- Yamaha Motor Co., Ltd.

- Accell Group N.V.

- Gazelle (Royal Dutch Gazelle)

- Moustache Bikes

- Gocycle

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

What's Your Reaction?